The Taxman, otherwise known as the Mississippi Department of Revenue, wants to tax the short-term renting of homes and apartments. DOR filed a notice of a proposed amendment to an existing rule with the Secretary of State on March 24. A hearing will be held today at the department's Clinton office at 3:30. The proposed amendment redefines a hotel or motel to include single-family dwellings:

This provoked no small amount of fury from opponents. Representative Jay Hughes (D-Mount Vesuvius) erupted on Facebook:

Thanks to your SECRETARY OF STATE Notice and the MS Department of Revenue (both controlled by your Supermajority), let me introduce you to the super fresh new TAXES, hot off the presses, up for passage this Wednesday at 3:30 in the D.O.R. in Clinton:It is hard to see how Secretary of State Gibbit Hosemann has anything to do with this amendment. The only role he has is posting proposed amendments and rules as required by law. Mr. Hughes would have to take the same action if he were Secretary of State. The Secretary of State could make it easier to find the notice on the website but he has nothing to do with the promulgation of this amendment. That is all the responsibility of Herb Frierson and his Clinton cohorts, which Mr. Hughes knows all too well.

RENTING house, rooms or apartment for less than 90 days:

• Airbnb & VRBO Nightly Rental Rates: Sales & Tourism TAX

• Shampoo, Soap, Toilet Paper, Coffee, Treats = Sales & Tourism TAX

• Linens, Towels, Coffee Makers = Sales & Tourism TAX

MUST be invoiced and collected separately.

This is Part B of the new Economic Plan called “TAX SHIFT”.

Make sure you object with your leaders now, or sit back and start collecting for them. (Oh, and this is only one of several new ones coming your way).

Jay Hughes

It ALL starts with education!

Russ Latino, the current Lord Protector from Taxation, is the state Director for Americans for Prosperity. He told the Clarion-Ledger yesterday:

Russ Latino, state director for the conservative Americans for Prosperity, said the state appears to be "hurting the little guy" with the proposed tax change on short-term rentals.Actually, Russ, a better use of the horse and buggy is more appropriate. Suppose the government is charging sales tax specifically for the sale of a horse and buggy. Along comes the car. The car is not taxed because no one dreamed of its existence when the tax code was written. These are two different forms of transportation. Should one be taxed while the other gets off tax-free? Why should the horse and buggy have to bear the tax burden?

"The average owner we're talking about here is renting out a house or room a couple of times a year for a little extra cash," Latino said. "They're not Conrad Hilton, and they shouldn't be treated like Conrad Hilton. Obviously, any income from rentals should be reported as income and taxed. But they are not operating a traditional hotel ... With the sharing economy— Uber, Lyft, Airbnb — as new as it is and starting to grow, government doesn't need to be applying these restrictions."...

Latino said: "I don't think we should be using tax policies to regulate changes in the marketplace."

"If we had today's policies and taxation in place back when Henry Ford was working on the Model A, I think it would have been shut down because of fears it would hurt the horse and buggy manufacturers," Latino said. "Government is being used to fight progress."

The landlords are performing the same exact function as hotels in exchange for money while advertising their services to the public in exchange for money. There is nothing wrong with the state taxing them as hotels if they are going to play in that field. The internet has truly caused a revolution in how things are done today. B2B is a wonderful tool that allows people to earn money off of the use of their homes while travelers save money. However, renting is still renting.

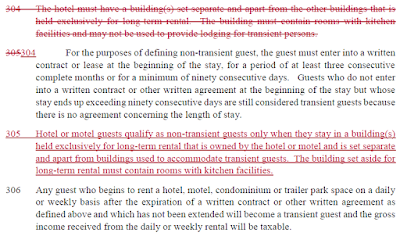

The proposed rule and notice are posted below.

22 comments:

Maybe Hughes' inclusion of Ribbit is a tell as to his future plans. Otherwise, why go after Hosemann and not Frierson and the Legislature/Lt. Governor?

On the other hand, seems like Frierson is trying to tax like an appropriator. He's trying to get every dime he can for Read and crew (that isn't an indictment of him, mind you) because he knows how tough their jobs is right now.

I wonder if Russ Latino realizes that horses aren't manufactured...

Why do I have a feeling that the hospitality lobby is behind this?

They are essentially motels or hotels. They should pay the same tax as their competition. In fact, they may already be subject to taxation under the same law as hotels, motels. As the economy changes, our taxes have to change.

Another question is the owners use of a homestead exemption. Seems like they would should lose it. At least part of it.

All for it. All the same arguments made to force our paying of sales taxes for online purchases apply.

Latino is a fool to fight for this hill. I'm sorry all the "little guys" -- you know, the poor working stiffs -- offering up their high dollar rooms, pool houses, condos, cabins and entire 5-bedroom houses for LSU's visit to Oxford in October are unhappy but that is the way it goes.

No Hughes, collecting the tax isn't a shift, it is compliance.

I would like to take stern issue with one of the commentators upon your computerized bulletin board, here. My name is Ezra Scofield, and my family has been manufacturing horses for nigh on two centuries. The horseless carriage nearly finished us, but we've soldiered on as proud American craftsmen making a fine American horse.

You whippersnappers need to stop buying those cheap Chinese horses. Buy American and keep a proud USA industry going strong!

Russ Latino and Jay Hughes. They do make a good pair together. Both have decided recently to go off the deep end lately and bitch about anything and everything. Jay because he is running for higher office; Russ because his bosses (local and national) pay him too.

Herb Frierson is actually just doing his job and enforcing what laws exist. The B&B business is a business. Businesses are supposed to pay taxes. Businesses that sell products or services are supposed to pay sales taxes. DOR is just keeping its regulations and interpretations up to date with the current economy - which, surprisingly, is what we pay them to do.

And as has been noted above - to claim that this is a shot at the poor, working class guy is so laughable it doesn't even merit Latino's level. The folks that own these properties don't fit that description and that is beside the point that they aren't the ones paying the tax. The folks who are renting out a house, apartment, condo, etc aren't the poor working stiff either. Last time my construction crew went off to work away from home, they stayed in a low cost local hotel or motel - not a B&B. They were all occupied by Russ and his UM buddies who were spending the weekend in the Grove.

If we want to "level the playing field," we should do it by decreasing taxes, NOT increasing them. The gov just wants more money for its greedy little enterprises. The beast is never satisfied.

The truth is: we are a poor state. Period. We have limited resources to generate revenue from which to keep our state in business. Our problems run deeper than any new way of taxing new businesses that the tax law didn't account for, which seems to be Mr. Frierson's specialty. He doesn't help create new forms of revenue collections - he is busy finding ways to keep revenue collections where they need to be. Good for him. He is doing a great job of it. Bad for us. We have one of the suckiest economies in the United States. And I don't care what the ridiculous unemployment numbers are that the state employment misfits release. They have zero clue what is really going on with the working and non-working population. I don't believe any data they release holds value. Another bloated state agency that is the epitome of stuck on stupid.

We can also complain all day about the ridiculous ways our state leaders seem to be trying to coverup the reality of our shrinking revenues while continuing to slash taxes for businesses. What. A. Joke. We have no leadership. A simple drive through this state will tell you that.

Suggestion to all of you keyboard jockeys - take a different route next time you're headed to an Ole Miss football game. Yes, it might cost you an extra hour or two, but it's worth the drive just to see what the real state of the state is for yourself.

Good news: Tater's reign of terror as Lt. Governor will be coming to an end soon. There is almost zero chance anyone will be able to match him for the governor's election. Well, unless, he really screws up between now and then. But I won't be holding my breath waiting for it to happen. He is good at covering his tracks. Let's hope someone he doesn't own or control is elected to be our next Lt. Governor. It really is the only ray of hope we have in an otherwise dismal future.

The state budget has increased by almost 2 billion dollars in just the last few years, so I don't think it needs more tax revenue. The size of government should be decreasing unless population growth demands a comparable increase.

2:05, I am all for decreasing and cutting taxes. But I am also all for everybody that owes taxes to pay them. We expect every little Comfort Inn, Motel 6, as well as the Beaus and Palaces to pay the taxes on their hotel room rentals. Others that rent rooms for short term purposes should pay as well. DOR is actually just doing the job that they are put there to do.

Want to cut the taxes on thes B&Bs? Fine. Cut the taxes on the Motel 8s as well. While you are at it, cut the taxes on those "motels' on old Hwy 80 that rent by the hour. But to tax the hourly rentals and the daily/weekly rentals that have the name 'motel' in their title but not tax those that call themselves 'resort' or B&B is not the way to cut taxes. Nice try, but AFP wasn't put in place to determine existing tax laws of our or any other state.

2:45 will I find any of those shacks and poverty houses you want me to see on that different route into Oxford listing rooms on Airbnb?

I'm not a tax attorney so I have no idea if these thoughts or comments are worth considering.

But I think @1:03 may have a point as far as homestead exemptions. Also, if an owner is claiming mortgage interest on their income taxes, that might need to be adjusted as well.

But let's say this is a second house, without homestead exemption. I wonder if the costs in maintaining the house when it is not being rented can offset the profits from renting; just as the costs of a hotel offset profits when it isn't full. If so, someone renting the space has to include the tax (which is paid for by the customer not the property owner) but all their expenses would likely wipe out any actual profit. Treating these folks like hotels would generate additional hotel tax, but I imagine would be a net loss for the state when the profits (which would be at a higher tax rate) aren't taxed due to the costs exceeding them. But then maybe that's what people are already doing.

3:13 - glad you aren't my tax attorney or CPA, but you do at least admit on the front end the possible value of your thoughts.

If this is a second house, w/o homestead, then the owner is doing one of two things. Either declaring this rental income as income for tax purposes and if so I would bet my last night's rent on the fact that they are also depreciating it, cost of maintenance, taxes, insurance, etc. If they are not declaring the income - which I would bet some are not doing - then they would have a hard time getting away with those deductions. Either way, the requirement of the owner charging the renter a sales tax isn't going to change the income/loss profit tax issue.

Frankly, as one who has owned rental properties before, I would bet that they are already declaring the income and all the deductions because (as our current president well knows) that is a prime reason for owning rental properties of any kind. It provides a way to delay the income by turning it into capital gains upon the eventual sale of the property.

In my 'professional' opinion, I don't believe the charging of sales tax on the services and sales generated by renting these rooms will provide any negative revenue to the state from causing new deductions to be taken that are not already being declared.

Russ Latino...the free market conservative working for a think tank that produces nothing but internet posts.

And people wonder why the economy struggles to grow. Its called productivity. Its what businesses do.

Russ Latino is right. This is absurd. The amount of paperwork involved, will make complying with this, absolutely untenable for the little guy. The 'Hospitality Lobby' knows this.

It was a huge boon for Canton, to have movie people renting houses there, during the making of several movies. It really breathed life into that then-dying little hellhole of a town. But I doubt that people would have bothered to rent-out ANYTHING, if they'd had to fill out all those forms (and have their accountants fill out all those forms) for the few shekels they were getting in rent, if they were having to operate as "Hotels/Motels".

This is not about the Dollar-amount of the taxes. It's about the crippling burden of having to comply with all those extra forms and regulations. Anybody who's ever run a business, will understand this.

You've got to be kidding. Skip the collection because of paperwork? LOL LOL LOL Maybe the Airbnb crowd might want to skip the paperwork because they aren't even claiming the income on their income taxes at all? Hmmmm.

This is just keeping up with changing in marketplace. If short-term rental properties are going to internet for sales, instead of local management company (which would collect tax), why should the state let the internet evaporate its tax base. The guy in the Clarion-Liar is wrong. I don't think this is about the guy who rents his house once a year. This is about condo rentals that are pretty much full-time for rent, skipping out of the tax roles.

I just hope Hood runs for Governor on his anti-business, pro-trial lawyer record and his goals to raise taxes, grow government spending, and expand Medicaid under Obamacare.

When you contrast that record with Reeves decisions to cut taxes, controlling spending, killing bond bills when House wants to borrow too much, less overall debt, and his unwillingness to raise the gas tax or the internet sales tax, you get a classic difference of opinion on the role of government in our daily lives.

More government control offered by Hood vs. Less government control offered by Reeves.

That contrast is not likely to turn out good for the Obama-Clinton-Perez-Bobby Moak crowd in Mississippi.

@8:58 If Hood is elected governor, we will be paying $165/hour body shop labor rates thanks to his boy John Mosely being in his back pocket.

Should one be taxed while the other gets off tax-free? Why should the horse and buggy have to bear the tax burden?

You sound like a socialist.

Why not put it another way: "Shouldn't we penalize innovative people?"

This is a disgusting idea, birthed by statist scum. And it's the same mentality of the vile internet sales tax, to wit, let's "level the playing field" by confiscating wealth from additional sources.

Despicable.

Sales taxes - a tax upon sales. It is not a tax upon sales except those that have been developed from a better way of marketing. Far from being socialist, as 12:11 claims - it is a fair way of paying for a democracy.

Internet sales - sales. By a different marketing scheme, but still sales.

Rental rooms/condo weekends vs. hotel rooms - still business of renting rooms. Still selling of a service.

under your theory, anything that didn't exist when the sales tax law was implemented shouldn't be subject to tax. Figure out what all that would exclude and then explain your socialist concept.

Computers, computer services and parts; cell phones; internet services; HDTV, 'and of course certainly the brackets that hold them on the wall; three wheelers (yes, preceeded the also excluded 4-wheeler); etc. Where would you stop with your 'penalizing innovative people'?

Post a Comment