As expected, the markets punished the PERS porfolio as it suffered a -8.5% rate of return on its investments in fiscal year 2022. It could have been much worse but some investments saved the day.

Stocks and bonds in the second quarter killed any hopes of a decent return for PERS in FY22. The overall performance in the second quarter (final FY22 quarter) was -10%. PERS investment consultant, Callan Senior Vice President John Jackson, reported the performance of the following asset classes (second quarter):

Domestic equities: -14.3% (-16.7%)

International equities: -22.2% (-14.4%)

Global equities: -18.7% (-17%)

Fixed income: -11.5% (-5.8%)

Real Estate: 22.8% (1.5%)

Private Equities: 26% (1.2%).

The report on the private equity performance is somewhat incomplete. Mr. Jackson warned the reported performance lags three to six months behind the actual performance. However, any negative performance in private equities will be recognized in FY 2023.

Although it is a small consolation, the portfolio performed somewhat better than its benchmarks. The Russell 3000 suffered a return of -21% (-17%) while the S&P 500 fell -20% (-16%). Although stocks and bonds are thought to move in opposite directions, they have risen and fallen together since 2020.

The diversification helped save the day as well. Real estate and private equity make up 25% of the portfolio. The combined average return for the two asset classes was 24%.

|

| Click on image to enlarge. |

What does it all mean? It means The PERS portfolio shrank by $3.5 billion in the second quarter of 2022 (final quarter of FY 2022).

|

| Click on image to enlarge |

Kingfish note: Here are some napkin numbers that will give a better idea of what to expect when the annual actuarial report is issued in December.

-8.5%: Rate of Return

$3 billion: Estimated PERS benefits payments in FY22.

$2 billion: Amount of investment income recognized this year thanks to the 33% rate of return last year.

$1.3 billion: Deficit between contributions and payments. It was $1.3 billion last year. The deficit will probably increase. Expect $1.4 billion or so.

$800 million: The COLA will probably increase at least $850 million. The annual increase ranges from $47 million to $50 million the last few years.

2,300: That is the average retiree growth the last few years. Expect the retiree population to increase to nearly 115,000. It only passed 100,000 retirees in 2017.

61.5%: That is the funding level reported in December 2021. Needless to say, the funding level will probably fall a few points. Break out the jukeboxes and poodle skirts. PERS is going back to the 50's.

The Investment Committee reports are posted below. Start on p. 279 at the agenda.

Market returns for PERS since 2000:

2000: 8.4%

2001: -7.1%

2002: -6.6%

2003: 3.5%

2004: 14.6%

2005: 9.8%

2006: 10.7%

2007: 18.9%

2008: -8.2%

2009: -19.4%

2010: 14.1%

2011: 25%

2012: 0.6%

2013: 13.4%

2014: 18.3%

2015: 3.5%

2016: 1.16%

2017: 15%

2018: 9.2%

2019: 6.8%

2020: 3%

2021: 32.7%

2022: -8.5%

5-year average:13.34

10-year average: 10.3%

Assumed rate of return: 7.5%

Employer Contributions

2011: 12%

2012: 14.26%

2014: 15.75%

2019: 17.4%

32 comments:

So when will I be able to see those smug state retirees and lazy, worthless, state employees take their haircut? And I mean especially the ones getting paid six figures for governor-appointed, no-show jobs like Stacy Pickering!

Cut out the 12th check that is the answer, been saying it for 10 years. The interest earned is suppose to go back into the fund. Change the estimated rate of return to 4% on average.

Here’s an idea. Stop taking employees money and let them decide what to do with it. Hell, putting it in a online savings account with a 1.7% interest is better than what PERS is doing.

the vast majority of the readers on this blog think the stock market is something with a fence around it, tended by cowboys.

9:05

What an angry peasant you are.

The haircut train is barreling down the tracks.

When you are as large as PERS, with tens of billions of dollars under management....PERS basically is the market. PERS with their billions could buy out many of the S&P 500 business on the lower end of the 500. Its perfectly acceptable that PERS should perform somewhere around the same performance of the S&P 500.

9:30, so no December retirement check?

I think what you meant was 13th check. You do know it is not just PERs that has a market adjustment valuation?

@10:22am - Yeah, 1.7% is greater than the 10.3% 10 year average return… good ole Mississippi education.

So someone said,

"Hell, putting it in a online savings account with a 1.7% interest is better than what PERS is doing."

Really??

So PERS averaged over 10% a year for the last 10 years and you think that 1.7% is better? Someone does not understand the concept of compounding.

The SS Supercuts will be arriving at the Port of Gulfport very soon.

Better hope you saved enough in your 401k and IRA like the rest of us.

Sounds like we got a lot of jealous people here who didn't work for an employer who provided a retirement program.

Kingfish: Where does it list the asset managers' fee structures?

Also, +30% of Global/International exposure is ludicrous.

@12:01

Those type of Ponzi schemes no longer exist in the private sector. Only government has the power rob the taxpayers to keep the Pension ponzi’s propped up.

The covid vaxx is going to help Social Security and gov pensions remain solvent. Very few currently working state employees will live to retire and draw a single check. If the vax is killing healthy teenaged athletes, how do any of these obese pencil pushers think they are going to make it?

@10:54am - What the hell are you talking about

@12:33pm - lol take off the tinfoil hat and put down the conspiracy theory crack pipe.

HAHA @11:31. The SS Super Cuts is coming, but not for PERS retirees. Don't forget the MS legislature is part of PERS/SLRP. They know they can't give a haircut to state employees without giving themselves a haircut and that my friend is not going to happen.

So 11:31 get ready to dig deeper in your pocket to kick more tax dollars in. Hopefully, you have saved enough in your IRA and/or 401k so it want be too much of a burden to you.

"Also, +30% of Global/International exposure is ludicrous."

Please do tell master allocator, what do you mean?

Am I going to be the first to say it. I'm jealous of PERS' -8.5% return in 2022. I'm down twice that.

@11:09am

"@10:22am - Yeah, 1.7% is greater than the 10.3% 10 year average return… good ole Mississippi education."

I think they are saying it's better for the employee. Taking that money and making a big return on it to give it to current retirees while PERS heads towards insolvency isn't a great deal for the employee. Will they end up earning more than 1.7% a year on the 9% collected from them each paycheck? I think probably so but that's going to depend a lot on politics and a little bit on law.

It's I guess possible that we just keep sending out paychecks until PERS has zero money. There's no mechanism under bankruptcy law to give retirees a haircut and just passing a state law to reduce payouts would likely violate the contracts clause. If that happens, then younger employees will end up with a negative return, and will be worse off than just putting that money in a bank account for them.

Everytime I start thinking that JJ readers are reasonably intelligent and informed, Kingfish makes another PERS posts and yall prove me wrong. Where is John Prine to tell us about jealousy and stupidity?

1. The 'haircut' clown has weighed in.

2. The ponzi-scheme genius has weighed in.

3. The imbecile who thinks his/your taxes go up (dig deeper) to pay for PERS has weighed in.

4. The 13th check idiot has weighed in.

5. Kingfish has his usual erection.

Now we return to our usually scheduled program of Jackson turd-water and the size of garbage cans.

6. The I hate everything about this blog but read it with vigor guy has weighed in too.

"Please do tell master allocator, what do you mean?"

Read slowly: It means that someone is betting +30% of a multi-billion dollar pension that foreign economies will outperform the U.S. Maybe you've heard about a little conflict in Ukraine? A European recession? A slowing Chinese economy? A strong dollar? COVID?...

It just appears to be an unusually risky strategy - confirmed by the poor performance. But you obviously read the comments instead of the content.

Smart-ass.

To 5:46

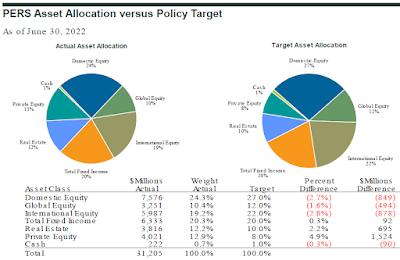

I'm seeing a different asset allocation than you are. On page 23 of the 700+ report Kingfish provides, it says PERS' allocation to Global and International equities is 3.5% and 4.1% respectively. Am I misreading the report?

"Read slowly: It means that someone is betting +30% of a multi-billion dollar pension that foreign economies will outperform the U.S. Maybe you've heard about a little conflict in Ukraine? A European recession? A slowing Chinese economy? A strong dollar? COVID?...

It just appears to be an unusually risky strategy - confirmed by the poor performance. But you obviously read the comments instead of the content.

Smart-ass."

Since you are telling people to read things, try reading up on Efficient Portfolio Theory. Then you will be able to converse with me on an actual intelligent level.

As always, the guy wearing the '13th check dunce cap' shows up on stage before the shepherd's hook can drag him off by the neck.

He actually thinks there's a magical free, extra check that hits the Christmas stockings each December. Too damned lazy to do minimal research or read a website...he continues (with hundreds of others) to wallow in his warped vision of the retirement program.

And, as always, Kingfish loves it since he has to beg for donations to float his retirement.

9:34, take the 20 year view, not the 6 month view.

Cut out the 12th check. Haha, that would definitely fix it.

@9:34 After the stock market crash (in 1987), the Nobel Committee rewarded two theoreticians, Harry Markowitz and William Sharpe, who built beautifully Platonic models on a Gaussian base, contributing to what is called Modern Portfolio Theory. Simply, if you remove their Gaussian assumptions and treat prices as scalable, you are left with hot air. They could have tested the Sharpe and Markowitz models—they work like quack remedies sold on the Internet—but nobody in Stockholm seems to have thought about it.

@9:34 After the stock market crash (in 1987), the Nobel Committee rewarded two theoreticians, Harry Markowitz and William Sharpe, who built beautifully Platonic models on a Gaussian base, contributing to what is called Modern Portfolio Theory. Simply, if you remove their Gaussian assumptions and treat prices as scalable, you are left with hot air. They could have tested the Sharpe and Markowitz models—they work like quack remedies sold on the Internet—but nobody in Stockholm seems to have thought about it.

Great cut and paste from Swisher. But, does not disprove the validity of the process when employed to remove mere speculation and minimize the affect of non-normal returns over time. The Gaussian Assumption is not perfect but it is still is the most useful way to measure distributions not only with investments but in engineering and physics.

If you have a better model/way then share it so everyone can benefit and maybe you too can with a Nobel Award.

Post a Comment