There was much gnashing of teeth when Governor Barbour created a commission to study PERS in 2011. The commission did what commissions do. It met, studied, and made recommendations. Ashes were smeared and sackcloths were rent as opponents shrieked at the mere thought of studying PERS. State Senator Hob Bryan suggested waiting at least five years to study PERS. Well, Senator, it's been eight years. Time to take a look.

Governor Barbour said at a 2011 press conference:

Mississippi has a retirement plan that is underfunded by more than $12 billion – a figure that has only worsened over the past decade despite hikes in taxpayer and employee contributions," said Gov. Haley Barbour, who created the commission in August to study Mississippi's state retirement system and recommend reforms to strengthen the plan. "In 2001, PERS had a funded status of 88 percent of assets needed to fund its liabilities; today, that level has dropped to 62 percent, far below the level recognized for such plans. Taxpayers are putting in about 50 percent more than they once were, but the system continues to fall farther behind. We must reverse this trend to protect our retirees and taxpayers future." Earlier post.

Neither the legislature nor PERS Board of Trustees adopted any of the commission's recommendations, much less discussed them. Mr. Bryan recommended ignoring the funding levels as they were only based on assumptions. Well, it has been eight years since the reputed genius of the Senate said wait a while. How has PERS done since 2011?

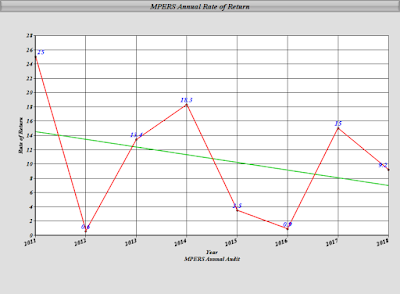

The rate of return has actually been pretty good. PERS enjoyed an average rate of return of 10.7% since 2011 - beating the assumed rate of returns of 8.0% and 7.75%.

However, the number of retirees grew 26% in just eight years.

The unprecedented amount of retirees drove a gap between contributions and benefit payments that more than doubled since 2011.

The result is a funding level that remains stuck in the mud, despite decent market returns on the PERS portfolio.

The actuarial assumed liabilities increased a third from $12.3 billion in 2011 to $16.9 billion last year.

PERS also raised contribution rates twice since 2011: 14.26% to 15.75% in 2013 and to 17.40% last year.

So, Hobbie, how is PERS looking after eight years? A deficit that doubled, unprecedented retiree growth, and two employer (us) contribution increases despite earning over 10% in the markets. Is it finally time to study?

38 comments:

Kingfish: Since you called Hob out, my bet is still on...that his PERS check will rival any being drawn and after about nine years, he'll not only rival, but will lead the pack.

Hob Bryan, The Blowhard of the Mississippi Senate.

Full retirement at age 45 (if you have 25 years) is asinine. 3% COLA is asinine when the inflation has been below 3% for 9 out of the last 10 years.

Legislature should be held liable when today's workers get screwed. Not the legislature as a body, but legislature as in the individuals serving right now. This is such an easy fix, but the longer they wait, the worse the fix will be.

The annual reports coming out of PERS are nothing but puffery. Somebody with some balls should include a few exhibits to show what the unfunded liability would be if they make tweak a, b, c, etc to the plan. Its just math, run a few models and show us the result.

You have a bunch of lawyers and farmers in the legislature who could not explain pension accounting if their pension depended on it. Nor discount rates nor any other financial term.

Shouldn't it be public record who the top 100 pensioners are? With and without the 13th check.

You publish that list and this blog will explode. And we might actually see something done.

Note to those who constantly bitch and moan about PERS and have never paid a dime into it, STFU and go find something else to whine about. I worked for over 30 years in a law enforcement capacity, missed holidays, kids birthdays and a lot of other things while trying to keep your worthless ass safe. I know that you could care less, but since I am now retired and drawing the PERS pension that I paid into for all those years, quite frankly I don’t give a damn what you think.

I just caught a news story about the new Louisville Chief of Police. He's a retired MHP officer PLUS a retired National Guard colonel. In just a few years he'll have another pension fund to keep him from starving in his later years.

Is he already drawing from the MHP pension? How about the MS Guard?

Everything's coming up ROSES for those who know how to play the game.

@ 11:29 AM - you can see in the footnotes of the 2018 CAFR (Note 5 - net pension liability) that a 1% decrease in the discount rate (from the very aggressive 7.75%) would cause the PERS liability to increase to $21.9 billion from $16.6 billion as it currently stands.

@ 12:06 PM - everyone appreciates your service, but we all "pay into" PERS (whether directly or indirectly) as it does not live in a vacuum as it relates to the state budget. And I bet your children and future grandchildren might care a little when this dragon is set loose on people who have no idea what is coming

@12:06 PM

I know that you could care less

could care less

Yeah, checks out. That's a cop.

The ignorance is astounding. I GOT MINES TO HELL WOTH THE REST OF YOU.

lol

For starters it's not full retirement after 25 yrs, it's 50 percent of your high 4

Look, I don't have a problem with drawing your retirement after 30 years or 35 or 40 as long as it is scaled based on full retirement after 35 or more. My objection is and always has been the 13th check. That money should be used to help fund the program. Hell, if the investment average for the year is 7% you don't get an extra check at the end from Social Security. With PERS you do receive an extra check based on return and then your annual payout is adjusted for the next year. Bad mistake adding the 13th check.

108 - the fact that its your "high four" rather than your 'last four' is part of the problem. Granted, this doesn't affect a large part of the beneficiaries, but it certainly takes care of a large enough percentage to make a difference.

Example - a local attorney, practicing law but at the same time being the city attorney, or board attorney, for a few hundred a month. Goes to work for the state at $80 - $100k per year for four years and draws retirement on that amount. Or, the reverse, an elected DA, serves four or eight years, but not long enough in the system. So after defeat, gets hired on as a city attorney and puts in enough years to qualify. Doesn't draw his pension (that according to the cop above, HE paid into) based on an average, or last four, but on that one term in office. Sweet deal, especially after being given the perk of a 3% COL, compounded annually, by Musgrove, Ford and Tuck in order to slip in their SLURP retirement boondoggle.

KF--Why does MHP have a separate retirement from other state employees? Do they also draw state retirement? Also, I was told several years ago that MBN agents were routinely assigned to MHP for a short time so they could draw both MHP and state retirement. Is that true?

Down sizing government or as the republicans say "right sizing it" is adding to the problem. Less people paying into the system. Republican leadership is causing this mess and they are the ones ignoring it. It figures.

3:25 - What a great solution!! Why hasn't anybody thought about that before you?

Let's see. Hire more people and put them on the public payroll in order to save the outdated defined benefit public pension system. Yes, it might help in the short (2-3 year) term, but it makes the long term issue worse. Besides the fact that the payroll cost to the state would increase and have to be paid for with other tax dollars.

So - we hire someone at $60,000, that individual pays 9% into the system (of course, the state would have to match that with 17.5%) and that 'extra money' makes the system a little more liquid.

But, the $60,000, plus of course the other benefits that go with state pay (insurance, vacay, etc.) all have to be paid out of current year dollars - for every year from now until they retire.

Save PERS by putting more people on the public payroll - let me guess, you are a died in the wool Jim Hood (and all his friends) supporter.

Thanks for your advice; thank goodness we have some leaders in the state smart enough to see through this idiocy.

@12.06 PM

First, 12.27 PM is right - the taxpayers of MS are all on the hook for PERS. State/local employees put 12% into PERS, but the employer (i.e. tax dollars) put in over 17%.

Secondly, I (and many others, including posters to this blog) are sympathetic to your situation, but that is exactly why there is so much emotion around this issue. You may go to your grave having been paid your full retirement with 3% COLAs every year, which is great for you, but someone someday is going to get screwed. This is math - it doesn't simply fix itself. If PERS continues same course and speed with no adjustments, it will run out of money - plain and simple.

Well, Trooper, no one begrudges you your retirement. I want you and your future troopers to enjoy it as well.

Having said that, consider this, the numbers are going the wrong way. Unprecedented level of retirees and a deficit between contributions and payments that grows every year.

Right now is the time to study PERS. It has around $27 billion in assets, market returns average over 10% for the last 8 years, in short, it is easier to see if changes should be made than down the road. If it gets down to the mid-50's or low 50's one day, what do you think will happen?

The state simply does not have the money or even GDP to fund a large-scale bailout of PERS. It is bigger than anything in the state. Anything. Contribution rates can only be raised so much. That $75 million increase this year could have gone for some teacher pay raises but no one thinks about that.

As for the state cutting employees, that might be true to some degree but PERS includes all county, municipal, and IHL employees. The retirees went over 100,000 in 2017 and higher last year. Even if the state had not cut government, the number of retirees would have still gone over 100,000. In other words, the deficit would have worsened but more slowly.

I'm not against defined benefits plans or pensions per se. Make the numbers work and I'm down with them. But screaming bloody murder over the mere suggestion of reviewing PERS is intellectually dishonest and cowardly.

12:06. I wouldn't care if I never had to put anything in PERS. I have. All taxpayers have. When it blows up, who is going to have to cover it? You? No. Us. The taxpayers.

Kingfish should have joined 8,000 others in the Metro and hung out a 'Financial Planner, For The Children and The Family' shingle instead of becoming a beat reporter. But, then he wouldn't have the Blog Radar Button at his command.

1:57 adds this: "...the fact that its your "high four" rather than your 'last four' is part of the problem. Granted, this doesn't affect a large part of the beneficiaries, but it certainly takes care of a large enough percentage to make a difference."

I posted a response but Kingfish decided he didn't like it. Under which set of circumstances (other than demotion or an across the board furlough) would the last four not also be the high four? That would be so rare as to not even make a difference.

And as everybody with walkin' around sense knows, it's rampant throughout all agencies that people are promoted in order to pad their income for their final four years, which has a tremendous impact on their retirement income.

Imagine what Pheel Brant's PERS check will be. Bill Waller's when he retires after being governor for eight years. Cecil Brown. Lynn Fitch. The courthouse gang in most counties. A cop who became the chief who might become the sheriff. When you're in the right 'circle', "High Four" becomes the name of the game and the COLA is just icing.

State employees are leaving at higher rates because contrary to popular opinion many of them are marketable. My spouse and I had no intention of retiring after 25 years (its now 30 and has been for awhile) we were committed to our jobs and to this state. The bottom line is that the state wasn't committed to us and between poor health insurance, no raises, and no replacing positions we decided to try our hand at the corporate life we were constantly told we couldn't hack. We should have done it years ago. Far superior insurance, annual bonuses and raises, continuing education paid for and so on. Is the retirement plan is good? No, corporate match is dollar for dollar to 9% but the other benefits and salary offset that well in my favor. I'm in favor of rolling back the date of the 13th check from 55 to 65 depending on number of years to retirement and possibly eliminating it entirely for new workers. However, that will only work if at the same time you increase other benefits and salary too offset. I'm going to bet the current cabal isn't going to make that happen.

@5.14 PM

Thank you very much for your response to 3.25 PM. I am so sick of hearing this argument!

There is clearly a very acute misunderstanding on the part of a lot of people who simply cannot grasp that the sole source of funding for PERS is tax dollars:

1) Tax dollars pay the salaries of state and municipal employees who then defer their 9% (or 12% or whatever) into PERS, and

2) Tax dollars fund the state and municipal agencies who have to chip in the other (and larger) 17.5% directly.

Consequently, you cannot separate the PERS issue from the overall fiscal picture for the State and municipal entities (cities, school districts, etc.). Adding more employees to these payrolls actually makes the situation worse, not better.

Well, crybaby at 9:00, why don't you tell the rest of the story. You kept telling a reader to "kiss my ass" over and over in the comment. Don't like the fact I didn't approve it? Tough luck.

Not a crybaby at all. Just wondering why 'kiss my ass' is inappropriate but the F-word and all other manner of vulgarity is not. That's the real rest of the story. Tough luck indeed.

You obviously don't take kindly to any opinion that is in contrast with your own. But, that's OK...as long as we all recognize it and can move on from it.

It's really hard, though, to keep up with who it is you're pandering to on any given day.

Kingfish obviously is not a fan of historical accounts either. But that's OK too. lol.

@5:14 and @9:53. People aren't staying in government and retiring like they used to. You are ASSuming that all these added people will retire from the state. It doesn't happen. We need more employees.The state is barely able to take care of our needs with the reduction that is going on. Heaven forbid, don't go to get your drivers license renewed. Get staffing back up to a level where we can be provided our basic services. Have them put their money into the system. Use it to make interest from it. Have them leave and take their basic contribution with them. There are 2 good convincing sides to every argument. Or let me guess, you're right and that's it?!?

@1.31 PM

I don't know whether the state is adequately staffed to complete all of its functions efficiently or not. I won't argue you on that point, and I wouldn't doubt that being the case. However, that is a completely different issue than the PERS conversation.

My argument is that adding EEs to the state/local payrolls doesn't fix PERS. It actually exacerbates the situation by soaking up more tax dollars.

For 1.31 PM and anyone else who has bought into the ludicrous idea that adding employees to the state/local payrolls is a fix to the problem - please observe the math:

Hypothetical $1 million in tax revenue and $60K/head for employees. Start with 10 employees, then grow it 50% to 15 employees:

10 Employees 15 Employees Change

Tax revenue 1,000,000 1,000,000

Salary 60,000 60,000

P/R taxes 4,590 4,590

Health benefits 2,000 2,000

PERS contribution (17.4%) 10,500 10,500

Total cost/EE 77,090 77,090

Number of EEs 10 15

Total cost 770,900 1,156,350 385,450

Surplus/(Deficit) 229,100 (156,350)

PERS funding:

ER funding (17.4%) 10,500 10,500

EE funding (9.0%) 5,400 5,400

Total funding/EE 15,900 15,900

Number of EEs 10 15

Total PERS funding 159,000 238,500 79,500

So, yes, PERS funding grows by 50%, but it increases state/local spending $4.85 for every $1.00 that goes into PERS. How you gonna pay for that?

12:06- You will care when the system goes broke. Then you will expect the rest of us to foot the bill. PERS is a broken system. You know it, we know it. The reason it doesn't get addressed is because our so called leaders are gutless. They kick the can down the road. PERS will be addressed one way or another.

BTW- Give the "I worked much harder than you" argument a rest. Plenty of people worked their ass off for many more years and end up with no pension of any kind.

Somewhere, there has to be a projected date at which the cash will run out. For example, SS will run out of cash in 2035. PERS has to have that estimated date.

The cash will 'run out' whichever of these occurs firt:

All current contributing employees die or quit.

The value of a dollar drops to five cents.

The legislature votes to quadruple their own 13th check.

The post at 3:03 is hypothetical nonsense.

Kingfish is on target with his analysis. As Gov. Barbour said and his study commission found, PERS is not financially sustainable without systemic changes. The longer politicians wait to fix it, the more costly a fix will be to both taxpayers and retirees.

The state auditor should take a look to see how many upper level "managers" etc. were deliberately moved into higher level positions merely to max out their "highest four years".....somewhere it says that this practice is illegal....but it goes on day in/out in Mississippi.

This is no different than the Mississippi Department of Education (MDE) "admin" costs skyrocketing over the last ten years, while teacher pay remained the same AND the number of students FELL. In the PERS system, LOTS of old-timers making BIG salaries coordinated their retirements with making sure they maximized their four years....All the state auditor has to do is look it up, check board minutes to see how/if/when those salaried positions were taken and why, as well as if salaries were themselves secretly inflated.....many a board minute gets changed, erased, etc. all the time to cover their tracks. Ask anyone. The old guard over the last ten years has been financially raping Mississippi.....and especially while they're on the way out the door......and 13th Checks are horseshite.

"As Gov. Barbour said...."

Bill Crawford or whoever you are...do you really think we needed Lumpy Barbour to tell us that? Really? Has the man ever had an original thought?

If A Train Traveling At 400 MPH

It's simple math, and if you can't grasp the concept, you don't understand arithmetic above a 7th grade level. But don't feel badly, because clearly most of our state legislatures are equally ignorant, which is why PERS is in the condition it is.

Hiring more people into state government increases the cost to taxpayers. It increases PERS contributions, but it costs almost $5 in additional tax dollars for every dollar that goes into PERS.

Go ahead, 9:19 - Keep making shit up. We'll be here eating popcorn all day long and most of the night. Entertain us.

Post a Comment