As tax collections continue to falter, threatening more mid-year budget cuts, our legislative leaders scurry to shore up the brilliance of their tax cut agenda.

They brought in an “outside expert” to say they’re on the right track.

Nicole Kaeding, an economist with the Tax Foundation, told them that adding more consumption taxes and reducing corporate taxes is the right way to go. In particular, she recommended charging sales taxes on services, such as those provided by doctors and lawyers, eliminating sales tax holidays, and upping gas taxes. She called corporate taxes the “most harmful” for growth.

Kaeding’s comments were predictable given her career in organizations sponsored by the multi-billionaire Koch brothers. Owners of Koch Industries, the second-largest privately held company in the U.S., the brothers have built a huge network of libertarian and conservative think tanks and political organizations to influence government policy and elections. Among these are the Cato Institute and the Americans for Prosperity Foundation that Kaeding worked for before joining the Tax Foundation. Both organizations promote the Koch brothers’ crusade to minimize taxes on the wealthy and eliminate corporate taxes. At the Tax Foundation Kaeding’s focus is making state tax codes more favorable to businesses.

Speaker of the House Philip Gunn applauded Kaeding: “I think you have confirmed and affirmed many of the decisions we’ve made,” the Clarion-Ledger reported. “Reducing the corporate tax burden is a path toward economic growth and stability.”

Lt. Gov. Tate Reeves liked her focus: “I believe our goal should be to make Mississippi the most competitive place in America to invest capital and to provide for more and better paying jobs,” the Northeast Mississippi Daily Journal reported.

Perhaps state leaders will pause and reflect on Kaeding’s data. It showed Mississippi in 2012 (before pending tax cuts) was already highly competitive among neighboring states. Mississippi’s Business Tax Climate ranked noticeably better than Alabama, Arkansas, and Tennessee. Kaeding’s slide on Corporate Income Tax rates showed Mississippi ranked among the lowest nationally, and better than all neighboring states. (KF Note: Um, what about Texas and Florida?)

If tax competitiveness is the real key to growth, then Mississippi should already be outperforming our neighbors. We’re not.

Legislators should hear presentations from economists not so indoctrinated into big money tax policies. They might find that Mississippi’s mix of poor people, hard-working middle-income families, and small businesses would fare better with a fair mix of consumption, income, and business taxes.

Indeed, the same day Kaeding spoke, Kiplinger ranked Mississippi 9th on its tax-friendly states list. Editor Sandra Block said, “Mississippi has always made our tax friendly list.”

Nobody likes taxes. They should be hard to raise. When collections are excessive, they should be cut. And, spending should be controlled so no tax dollar is spent unnecessarily.

That said, the federal tax mess is one thing, our state taxes quite another. Relying on national tax policies promoted by the rich and powerful may not best serve rural Mississippi, particularly when revenue collections are under water and state tax burdens are already competitive. (Does this mean Mr. Crawford opposes closing down sales tax holidays? The sportsmen version is a good place to start.)

*Sales taxes: Mississippi’s oldest-in-the nation Sales Tax was created when nearly all economic transactions revolved around the purchase of goods; today two-thirds of economic activity revolves around the sale of services, which are untaxed. Naturally Mustache-in-Chief Jeff Smith jumped up to oppose taxes on attorney fees.

*Sales taxes are perhaps the most reliable – less subject to the whims of the economy – tax source. The states that rely primarily on income taxes see those taxes fluctuate more.

*Mississippi’s state-only Sales Tax ranked 20th, and was very competitive with neighboring states whose state and local sales taxes were often higher.

*Job Tax credits: The foundation argues these don’t typically increase economic activity as much as shift it. It is particularly critical of film-industry tax credits.

* Dr. Kaeding also pointed to Indiana, North Carolina and the District of Columbia as successful examples of major tax overhauls in recent years that ultimately generated more economic activity and did not drastically impede government revenue for services. (She specifically noted that Kansas’ lawmakers refusal to implement a broader base of new taxes to offset targeted tax cuts was the opposite approach than what the Foundation recommends as sound policy.

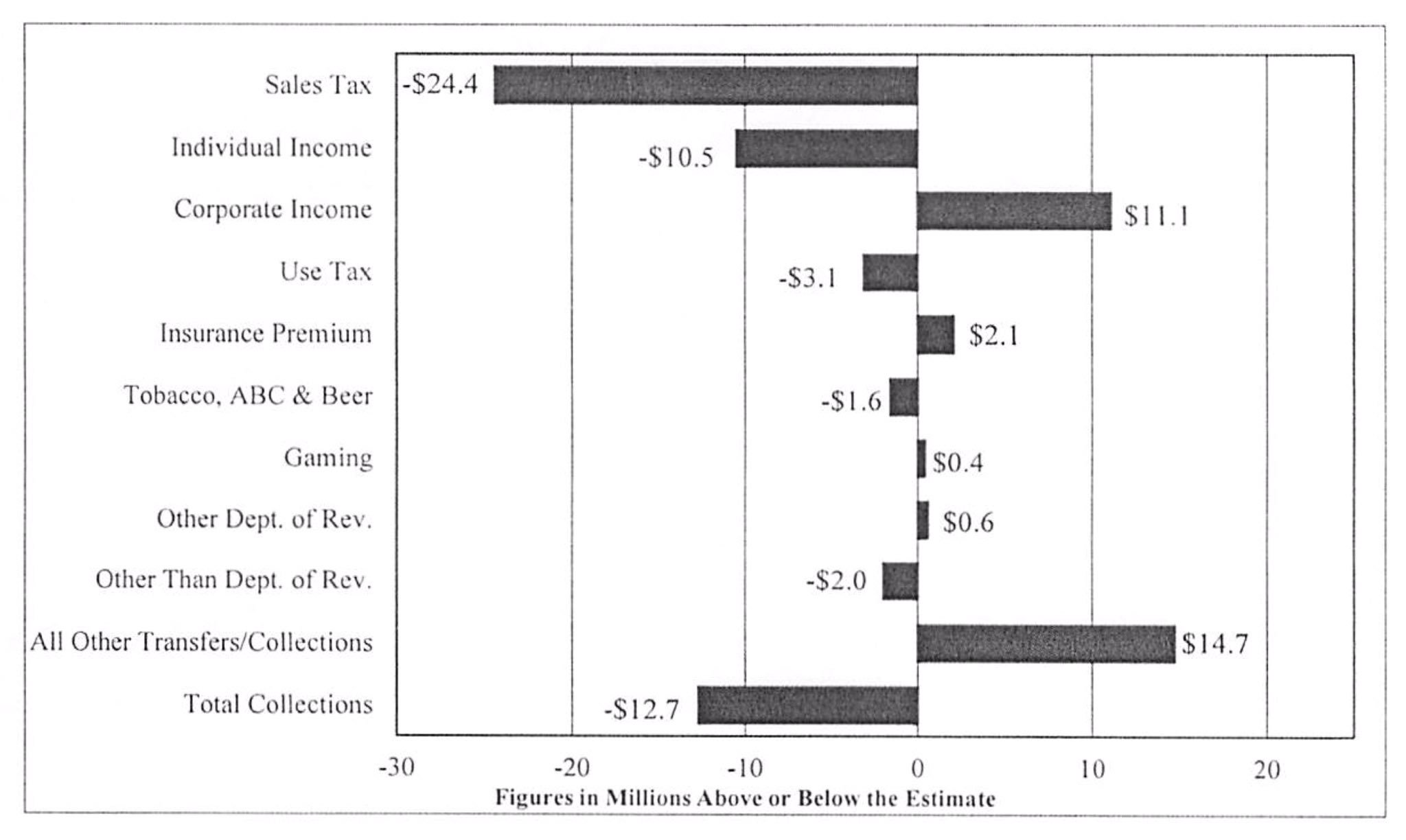

*Representative Greg Snowden posted this chart of sales tax collections on Twitter. Sales taxes are down but corporate income taxes are up.

25 comments:

Yes, well, one should always take advice from someone who works for two men whose beloved grandfather loved Hitler!

After all, we have no economists at any University in the State who might know Mississippi's economy and actually care about our State, right?

I guess she failed to mention that the taxes she proposed are called " regressive" taxes for a reason. That reason is that they hurt the poor and the middle class and have a regressive effect on the economic ability of the majority of the existing population to buy goods or services. And, you cannot attract enough corporations to create enough jobs in a short enough period of time to avoid extremely negative effects.

Oh well, the oligarchs in Russia love this form of taxation as well and I'm sure the Kochs embrace that model. All they need is a political leader like Putin to help control the flow in information completely with Big Lies. And, surely granddaddy told the brothers that all the industrialists in Germany supported Hitler. Once you have a dictator, you can create military related jobs and create labor camps for free labor!

Oh wait! They've found their leader! Stormtroopers website is thrilled and can't wait for The Donald and his minions to take control!

Hillary Invented Birtherism

Reuters/Ipsos: Race tightens in projected U.S. Electoral College vote

Yes, North Carolina's GDP grew but look at the median income and middle class stats.

I would also note that N.C. was attracting corporations and it was the time of banking crisis in 2008 that hit Charlotte so hard that is used for comparative data.

I would suggest you also look at what businesses are taking their business elsewhere since the Kochs teamed up with the Pope family in N.C. See what's happened to the cost of living and the decline of rankings like education at every level . And, here's one " improvement" you'll really love... in N.C., you can't seek medical care at the top medical centers on your own anymore. It works kinda like V.A. You have to go through your local and/or regional care hospitals first and be referred. And, oh,you'll love,too, how the private schools are thriving and the charters and public schools are struggling. And, until the court just overturned it, you couldn't vote in N.C. if you turned 18 within 90 days of the election. Thank you Delbert for not letting that happen here! And, those business and sports leaders pulling out of N.C. are doing so for social rather than business reasons, you are horribly naïve!

Confessions of a Hillary Insider

I am shocked at the audacity of Hillary Clinton to decry Donald Trump as a birther because her campaign not only pushed that item in a bid to discredit Barack Obama, but mounted a sustained campaign attack Obama on a broad array of issues. How do I know? I was part of that effort and was in regular email and phone coordination with Sidney Blumenthal. Sidney was the conduit who fed damaging material to me that I subsequently posted on my blog.

In some cases Sid Blumenthal actually provided a draft piece that I would slightly modify and publish under my name. Most of the time, however, Sid provided background information and researched material that I would use to craft pieces. How many? I am providing the links to 63 blog articles that I posted (and in one case was posted by Susan Hudgens, who assisted with the blog) between January 2008 and June 30, 2008.

But, if the libs have their way, you can piss in whichever bathroom you'd like to. And catch a glimpse while you whiz.

I still don't understand why we don't collect the tax on internet sales. It is the most common "consumption tax" there is. Consumers are supposed to be paying it anyways, it is just not enforced. It would also eliminate the unfair advantage to the brick and mortars of the state. Which is even better than a lot of tax incentives for small businesses. There is probably billions of dollars flowing out of this state mainly to save on taxes. Other states are doing it and it is bringing in major revenue that was being missed out on.

Consumption tax.....terrible idea.

Like relying on a lottery tax

Increase the sales tax on consubilies. Then at least some money woul come from the "underground" economy who don't pay any income tax on their non-reported income. Lower sales tax on essential items food, medical, utilities.

9:23 am Hillary did imply that Obama might be a Muslim during that campaign by saying " I don't know what's in anyone's heart" when asked. But, she nor her staff EVER questioned Obama's citizenship.

Unlike the birthers, she knew as did her staff that since Obama's mother was a U.S. citizen, so was he.

How birthers and Trump missed that obvious fact is amazing.

And, after Obama releases not one but two birth certificates ( the short form and the long form) and LONG after the birth announcement in the Hawaii newspaper was found, Trump was still playing the " birther" card.

Now either Trump is an idiot and can't hire anyone who can tell him he's wrong or he's a liar who is playing you and pandering to racists.

I think he and Clinton are both liars. She lies to cover her ass and the ass of adulterer she married.

Trump lies because he's a con man or liar and he is the adulterer.

He's lied about why he " couldn't release his taxes". His doctor can't be believed since he thinks it's good that Trump's testosterone levels are " twice that of a 30 year old when Trump is 70( both of them should worry about shrinking testicles as a result). Trump picks someone who sure tries to look like a Dr. Feelgood drug pushing quack.

I will hold my nose and vote for Clinton because she's the one who doesn't like the dictators in Russia and North Korea and because Trump is a loose cannon and the only explanation for his behavior that are kind is that he's in the early stages of Alzheimer's or senile dementia!

So , I'll hold my nose but the choice isn't hard.

8:43 Sorry to ruin your day but the Koch brothers are pouring all their resources into getting Hillary elected. They gave not one dime to Trump.

I know, I know, facts are nasty little things, aren't they?

Create a corruption tax,money will flow!!

PLEASSE. STOP. Blumenthal IS Clinton and Clinton staff.

Many internet sales are indeed taxed.

... Btw, the Blumenthal thing hangs upon a single reporter who had no verification for his story. Don't try to steal Trump's glory.

Tate is a financial genius. Said no one ever!

I would be all for a "consumption tax". Specifically on things such as gasoline and other motor vehicle fuels. Case in point: The State of California would give a great incentive tax break IF you purchased a hybrid or extremely fuel efficient vehicle. So naturally, many of them were sold. So many in fact, that the fuel tax wasn't doing much towards funding repairing the roads and bridges. So how do they fix that? With a NEW tax where they are planning on taxing you by how many miles you actually drive! Go look it up. The State of Oregon is proposing the same type of plan.

Insanity! Check out this link:

http://www.kpbs.org/news/2015/feb/17/california-plans-move-away-gas-tax-road-usage-char/

Why do people say things like 'A tax on business is a tax on rich people but a sales tax is a tax on the common man.' Seriously? Anyone who believes that is not paying attention. The consumer pays of the the business taxes and all of the sales taxes. IF a business was paying 20% tax on profits and the government raised the tax to 40% the business is going to raise prices to pay for the tax increase. The business owner is not going to work for free.

1:32 am The reason is that poor and middle class don't have the option of recovering tax costs by increasing income . Nor do they have the same options to reduce tax liabilities.

Worse the middle class and upper middle and lower upper classes are paying more tax because their taxes are going to reduced corporate costs and corporate research and development. They don't get favorable interest rates. Worse interest is no longer tied to the prime so that the poor are actually paying rates that used to be a crime and called loan sharking. They can't buy goods at cost for their personal use. They don't have their costs of living written off.

Walsh, the former CEO of GE, lived in a 5th Avenue residence completely decorated by GE, staffed by GE, maintained by GE, much of the entertainment caterer by GE, and when Walsh retired, it was depreciated and " gifted" to him.

I'd do very well if I could take a reduction in taxable income because I didn't have to pay for my cost of living.

You are over-simplifying.

What has happened since the '70's is that ( not small businesses) but large businesses and corporations) are no longer paying what use to be costs and risks of doing business or paying the ordinary living costs ordinary citizens have to pay. Worse, large businesses actually have lobbied for " regulations" unrelated to product improvement or safety to drive out competition. The Wall Street and banking debacle of 2008 can not only be directly linked to bad de-regulation ( particularly the regs that did send the S&L scandal culprits to jail and/or put them out of business) but no one went to jail for causing the recession because what they did was no longer a crime! Worse, perhaps, you have restored the ability for corporations to put a business cost on human life again by wholesale tort reform instead of specific reform to reduce frivolous lawsuits. And, if you are damaged, the company is fined. You are not made whole.

You are ignoring the real problem which is the need for tax and business reform. that is proportional to the benefits they get from living in a capitalistic system.

There are honorable , patriotic people who own the majority shares in many corporations. I've met them. But, we have created a monster where, unlike these still family owned and controlled corporations, we have a situation in the " big too fail" corporations where share holders no longer have any semblance of real control anymore. Worse, I'm old enough to remember where paying for political favors and influence was a crime and a politician didn't get paid to inform the people who pay his salary! It's one thing to hear a politician and decide to contribute to his or her campaign and quite another to pay to hear them speak. Should we be surprised that once we turned politicians into celebrities by making them feel more important than those who pay their salaries, that we have a real celebrity who is doing well?

P.S. If you are salaried, you are probably working 60 hours a week ( if you hope to advance) instead of 40. Could that possibly be impacting how are children are doing?

We have culturally forgotten that it's not just what something costs, but the value of what you get for your money. And, we've forgotten there are some things money can't buy like your children feeling loved and valued and taught how to survive in life by you.

4:35 pm You are behind the times, as of August, the Koch brothers are pouring money into Trumps campaign.

They were a bit pissy cause he beat their " boy", they didn't trust Trump and it looked like Clinton would walk away with it so it's easy why they wanted to seem to make nice with Clinton. But, now they probably believe that they'll get their charismatic leader after all. Trump's praise of Putin and Il immature baby in N. Korea surely gives them hope. They probably believe Trump for the same reasons I do that Trump got into it for the money never expecting to win. He needed a cash " fix".

There's a good reason Trump won't release his taxes. Things hadn't been going so well lately.

Try to keep up.

for mississippians who aren't moochers, koch brothers-funded organizations like the tax foundation and americans for prosperity are an upgrade over the manufacturers association, mec, the barbours, and other crony capitalists who have manipulated Mississippi's playing field to the advantage of the well-connected. the tax foundation's recommendations fail because those recommendations do not take into account that the mississippi legislature has developed a tax code that is anything but flat or fair ... unless you're a big outlet mall, continental tire, or a new markets tax credit expert! to have a tax code like the tax foundation envisions, the state legislature needs to reconsider the exemptions and subsidies they are giving to special interest groups.

4:35 pm You are behind the times, as of August, the Koch brothers are pouring money into Trumps campaign.

Link?

To get back to the point of this post - which has nothing to do with Trump/Clinton, except for Crawford's half ass attempt to tie everything that this legislative leadership does to a few national think tanks;

the idea of taxing all sales rather than just that of goods is not a tax on 'the poor', as implied by the generalization made here. The 'poor' don't generally employ the services of lawyers, CPAs, engineers, etc. But those purchases that are made by both in and out of state individuals and businesses are currently untaxed. Medical services (doctors, etc) for the so-called 'poor' are paid by Medicaid or other federal programs (i.e. regional health centers that do not bill for services).

Granted, House W&M Chmn Smith was an early opponent of the idea since he is an attorney. But it should be noted that the Chmn of the Senate Approps Committee, Buck Clarke, supported the concept - and he is a CPA whose charges are currently untaxed.

Looking at the entire sales tax program makes really good sense - over the years many groups have convinced the legislature to 'exempt' their sales: agricultural chemicals, seeds, etc., pollution control equipment, many others while we don't exempt groceries as do many states. Not suggesting that we should exempt groceries as again the 'poor' purchase most of their groceries with SNAP (food stamps).

Mississippi Sales Tax Exemptions

It is unbelievably regressive that MS charges the exorbitant tax on food and other necessities while wasting millions to "attract jobs" by subsidizing corporations when in reality the money they give away could be distributed to the poor and used to create jobs like road construction, repair of sewage and water systems, and running a functional law enforcement and judicial system while ALSO creating jobs - this state is so backwards it isn't even funny. Run by self-interested thugs, white and black.

Post a Comment