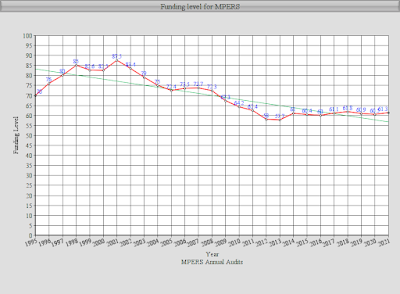

Last year should have been a great year for PERS as its investments generated nearly a 33% return. Let the good times roll. Time to party like it's 1999. The markets finally came back and PERS can invest its way to success. Well, not so fast my friend. While PERS killed it on Wall Street, a plethora of factors blunted the PERS progress to stability as the funding level rose less than a point.

PERS enjoyed a 32.7% rate of return from July 1, 2020 to June 30, 2021. The extraordinary gains translated to investment income of $8.7 billion, a gigantic increase from $857 million a year earlier. However, PERS only recognized $2.1 billion and will recognize the remaining $6.6 billion over the next four years.* The S&P 500 rate of return was 38%. The PERS Board of Trustees lowered the assumed rate of return from 7.75% in 2020 to 7.5% in 2021.

Unfortunately, PERS is composed of many moving parts and those moving parts stymied the progress made by investments as the funding level only increased from 60.5% to 61.3%.* The German spring offensive comes to mind.

Retirees only grew by 2,277, giving PERS a much-needed breather in retiree growth for two years in a row. However, even with smaller growth, the retiree population reached an unprecedented 112,158. It blew past 100,000 retirees in 2017 and keeps on climbing. Unfortunately, the number of employees supporting the system continues to shrink as retirees grow in number.

Active members fell by 4,182 employees to 145,673. 162,311 active members supported 86,829 retirees ten years ago, a difference of 75,482 and almost a 2:1 ratio. The two populations narrowed as actives now outnumber retirees by only 33,515.

The largest cuts in employees have been in state agencies and public schools. There were 32,618 state agency employees ten years ago but the population shrank 21% to 25,325. Public schools cut their employment from 64,252 employees to 60,108 - a 6% decrease. State agencies made up 17% of all employees while public schools were 41%.***

The employee reduction, smoothing, and retiree growth caused the deficit between contributions and payments to grow to a record $1.332 billion after stabilizing in 2020. What does it mean? PERS must use over a billion dollars of investment income every year just to pay the bills. If there are meager returns such as in 2020, that money comes from the PERS portfolio. Hence the funding level has remained stuck in the low 60's for half a decade.

The unfunded accrued actuarial liabilities increased to a record $19.4 billion from $18.7 billion in 2020. They were $14.5 billion ten years ago - 33% less. The massive growth in the unfunded liabilities occurred despite two employer contribution increases and a $100 million bailout several years ago.

PERS had a similar experience ten years ago. PERS enjoyed investment returns of 14% and 25% but the funding level actually fell thanks to retiree growth and other variables.

The PERS cost of living adjustment was $800 million in 2021. PERS Consultant Cavanaugh McDonald did not recommend any contribution increases for 2022.

* PERS "smooths" investment returns and losses over five years so no outliers skew the balance sheets.

** The market value-based funding level rose from 59% to 70%.

*** Shares of employee population (2012 proportion)

State agencies: 17% (20%)

Public schools: 41% (40%)

State universities: 12% (11%)

Junior colleges: 4% (4%)

Counties: 10% (9%)

Municipalities: 11% (11%

Other: 5% (5%)

Market returns for PERS since 2000:

2000: 8.4%

2001: -7.1%

2002: -6.6%

2003: 3.5%

2004: 14.6%

2005: 9.8%

2006: 10.7%

2007: 18.9%

2008: -8.2%

2009: -19.4%

2010: 14.1%

2011: 25%

2012: 0.6%

2013: 13.4%

2014: 18.3%

2015: 3.5%

2016: 1.16%

2017: 15%

2018: 9.2%

2019: 6.8%

2020: 3%

2021: 32.7%

5-year average:13.34

10-year average: 10.3%

Assumed rate of return: 7.5%

Employer Contributions

2011: 12%

2012: 14.26%

2014: 15.75%

2019: 17.4%

39 comments:

Ughhhh

Not that Kingfish researched, tabulated, summarized any of this or wrote a damned word of it....but we can for sure count on ONE thing. He will always, without fail, rain on any and every parade associated with even the smallest of accomplishments of the state retirement system.

And when you shine a light on that fact, he will always respond in the same fashion you will see him employ following this post.

So, let me just go ahead and take my lashes from him and admit that all state employees and retirees, including me, did nothing more than shovel shit and when we were not shoveling shit, we were leaning on the shovels.

So, go ahead, Massah...I've taken off my shirt and am sprawled in the public square waiting for your lashes.

Maybe time to pause those "13th checks" . Start with retired politicians, and administrative educators.

Include anyone with a 13th payment of 5 figures or more.

The answer to the problem with PERS is very clear: Hire more public employees.

I have no problem with state employees receiving retirement payment IF they would institute two reforms - 1. Get rid of the 13th check 2. Cap the salary the benefits are based on at $60,000 a year not the “high four year average “. Last I checked my 401 has no 13th check and doesn’t care what my salary was in any year.

9:41 am

Queen fish is ferocious and his resting bitch face and nasal flamboyant voice surely conjures up pain for anyone with ears…..

But he did give some praise and he’s not wrong that alot (maybe not you) of state workers do very little for too short a time to enjoy so much after retirement for life.

One side of My entire family has been on the state payroll since 1955. Retired in 1990 and still getting great money (and other govt benefits as they were last to qualify for everything)….and good for them right? Their kids? Same track though less lucrative but they will have decades of checks for zero work.

It cannot continue in this fashion….it simply won’t work.

So get all mad but one day the music will stop and it will be over.

The barber stands ready to help. Haircuts are inevitable.

One can be assured that if the 13th check is messed with....it won't be the big wigs taking the hit. Big wigs gonna do what big wigs do. And that is to bend the little wigs over and pound pound pound with no lube.

9:56, that's a choice you made. Actually, if you are invested in anything other than a savings account, your 401k should grow every year in excess of inflation, allowing you to slowly increase annual withdrawals.

how much are we paying wall street in fees?

The 13th check is a cost of living adjustment. Some choose to not get a 13th check, and, instead, have their monthly pension increased yearly. The net result is the same. Get rid of the 13th check, and the monthly pensions will increase yearly, having no net effect on the overall payout.

"PERS enjoyed a 32.7% rate of return from July 1, 2020 to June 30, 2021. The extraordinary gains translated to investment income of $8.7 billion, a gigantic increase from $856,957 a year earlier."

A year earlier the return was 3%. This year's 32.7% is approximately 11 times last year's 3%. But this year's reported $8.7 billion is approximately 10,000 times last year's $856,957. I wanna see the math.

11:46 : Bingo.

Yes, please stop talking about the 13th check....you either get that as a COLA lumpsum, or it's adjusted for each year.

The problem is all the old-timers in the last ten years that retired, and who are going to bankrupt the system because all the little fiefdom agency/cost centers have tyrannical idiots trying to build new buildings and other vanity projects that are COMPLETELY unjustified or sustainable.

Those administrative agency "leaders" should have been focusing on the people that make up their particular agencies, and the need for deliberate succession planning in every department. State workers are quitting/retiring far faster than their being hired, because of the short-sighted doofus Michael Scotts that were hired by bumbling boards and councils.

State work is a zero-sum game - if you don't understand that, you shouldn't get involved - because you will inevitably fuck it up.

9:41 If getting a check every month for life, with the 13th check is slavery, may I have a heaping helping please?

Maybe KF is concerned that those of us not getting a check a month for life will have to scratch around to pay others because the check recipients are too lazy to demand accountability.

1:05 : Some of y'alls opinion of folks who will get PERS for holding job 30 years is rather shitty. I will agree that many spend 30 years thumbing their ass and they are usually political hires......but a large number of them work their asses off and earn this crappy retirement. Most will still have to work full time after just to make ends meet. Life baby. The 13th check use to help keep employees up to retirement but the world and what they pay you just doesn't work anymore.

Another issue many don't talk about is people who have worked in the private sector for years making 30-40-50k annually or even less then towards the end of their retirement get into politics and eventually jockey for a state wide position making $100k+. They have paid in all these years a lower amount but will cash out based on the last 4 years. Case in point look at how many years a lot of these commissioner or dept heads stay. Most are 4 and done.

The damn the "13th check" is noting more than a description for the PERS COLA program.

Geeze!

It's only a damn yearly "cost of living adjustment".

(no different from social security).

Retired State Employees can choose to receive the COLA in monthly increments or their total COLA benefit amount in one annual payment.

(Thus the term 13th check)

In no way is it an extra "full retirement check".

Hell, in most cases it's not enough to even make a difference with one's family budget.

The level of uninformed stupidity by those posting on this matter is about what you might expect by a bunch of stupid "concerned citizens" that love to run their mouth and espouse fiery opinions without even a small fraction of the real facts in hand.

“Time to party like it's 1999.”

Question: What is the most boring and overused adage?

Attention 1:50 PM

Most State employees worked 25 years. The 30 year rule was implemented in 2009.

@2:29pm - Yeah, that’s not how it works. See 2:57’s comment.

For the Karen who claims his 401(k) 'doesn't care what his salary was', he forgets that his high salary allows him to participate and contribute the maximum each year. State employees, although they have no choice, in most cases are scraping to make ends meet and would probably rather have that cash in hand each payday other than socking into a failing system. And damned few can afford to contribute to the available deferred comp plan (that mimicks a 401(k))

The crowd that bemoans the retirement plan, led by the ignorant sock-puppet who chortles about 'haircuts', has zero knowledge of the state plan, how it's supposed to work, when it was a national leader and why it's often in the ditch. ZEE-ROH!

And then there's that other clown who favors capping contributions and benefits at a certain salary level. What a socialist/communist/liberal suggestion. What ought to be UN-capped is the amount after which high wage earners in the private sector no longer have SS deducted. That's insane.

Lastly, it takes a real Huckleberry-Knucklehead to think a retired state employee actually gets an extra-gimmee bonus check every December. That phase of the plan has been explained twice above, but it sailed in one ear and out the other of these knuckleheads.

Don't wait too long to decide if it will be a crew cut or just a trim?

Cap payments for the bigshots whose pension payments are based on highest 4 years of pay - especially the greedy part-time legislators. Tell them to go SLRP it up somewhere else.

4:27 PM

Unless you're making well over $100,000, I doubt anyone is contributing the whole $20,000 that can be put into a 401(k).

It's not a real COLA and you know it. It is a fixed automatic increase of 3% that is compounded.

The COLA is equal to 3 percent of your annual base benefit for each full fiscal year of retirement prior to the year in which you reach age 55 (Retirement Tiers 1 through 3, see table below) or 60 (Retirement Tier 4), plus 3 percent compounded for each fiscal year thereafter, beginning with the fiscal year in which you turn age 55 (Retirement Tiers 1 through 3) or 60 (Retirement Tier 4).

... when it was a national leader ...

When was that? What was the measure of leadership?

I applaud Kingfish for continuing to shine light on the top fiscal challenge the state faces. We can’t stick our head in the sand on this issue. Continuing to pass costs on to the employer (read: taxpayers) is not sustainable.

We also can’t ignore that the 3% annually compounded increase in benefits is a major reason that PERS is in the shape that it is in. Mississippi is a rare system in that it provides this fixed adjustment in the name of a COLA. Until recent months, inflation hasn’t touched 3% in many, many years.

When you screw the retirees after putting in 30 of their best years, they won’t show up with picket signs. They will show up with rifles and shotguns. State leaders know that. But cut taxes anyway.

As a current retiree I believe changes do need to be made. I certainly don’t want the system to collapse when I am too old to go out and get a job should benefits be cut. Some of the ideas proposed here, such as having a maximum amount to base retirement benefits on sounds reasonable, also changes need to be made to 13th check/ COLA. Politically no one in the legislature is going to make any changes that would effect current or soon to be retirees. Why not change the way the COLA is calculated at some future date? I am not smart enough to do an actuarial table to figure what that date should be, but it would need to be done in a way as to not cause mass retirement and also to give those who will be impacted a chance to know what the changes would be in order to plan appropriately.

Ideally, the State should do away with defined benefit retirement plan for employees and setup a 401K plan for employees to pay into with the State matching a percentage of what the employees contribute, with a cap on the amount the State would match. In order to do this the State would have to support the current system until the current members die off.

I am sure there are a number of ideas that could help stabilize the system. After working 37 years I don’t want to wake up one morning and find my benefits cut or eliminated and be too old or in poor health, not being able to get a job to supplement what I lost.

The cola needs to be changed to average salary and not the highest four years. The high average is responsible for a lot of waste in Higher Ed and K-12 administration. Admins with high salaries are kept around or are given raises to keep them around a little longer for their "four highest". I've been around long enough to know that didn't used to happen in the way it does now. The cola should also not start until 62 or 65 which would help. There is no reason to retire at 50 and receive benefits and the cola.

The average annual PERS benefit including the Cost-of-Living Adjustment is $25,638.

https://www.pers.ms.gov/Content/PAFR/2021_PAFR.pdf? See page 5.

The entire amount is also subject to federal income taxes.

"Anonymous said...When it was a national leader ...

When was that? What was the measure of leadership? February 24, 2022 at 6:43 PM"

For your first question...Do your own research. At one time, the system was touted as the healthiest of all such state systems in the nation. If memory serves, this was in the 80s.

For your second question...It not only makes no sense, there is no way to answer it. if you figure out how to 'measure leadership', let us all know.

The Blog Owner Sez: It's not a real COLA and you know it. It is a fixed automatic increase of 3% that is compounded.

Like it or not, the operators of retirement plans get to decide their own definition of how a C.O.L.A. Operates. If they decide a C.O.L.A. includes compounding, additional stocks or an annual box of Chocolate Twinkies, that's the plan operator's option.

While the Social Security Administration has its definition, there are multiple other plans with other definitions. No definition is, by definition, applicable to all plans.

Of course The Kingfish is at liberty to decide which definition he prefers but he is NOT at liberty to refer to one as 'real' while suggesting others are NOT real. He can still pitch his hissy fit and say he doesn't like it, though.

"Maybe time to pause those "13th checks" . Start with retired politicians, and administrative educators.

Include anyone with a 13th payment of 5 figures or more. February 24, 2022 at 9:49 AM"

Obviously another Luther who has no clue that what he calls a 13th check is a legally incorporated COLA adjustment included in the contract. It can be received once a year in December or it can be spread out over monthly checks. If he thinks it's just an extra bonus check, making 13....well, I've already told you he's just another Luther. (A Luther is a male Karen)

What was the measure of leadership?

What was the metric used to convey the leadership position? Are you really that dense?

For your first question...Do your own research. At one time, the system was touted as the healthiest of all such state systems in the nation. If memory serves, this was in the 80s.

Well then it didn't happen because your memory has gone to crap. Make the claim, back it up, otherwise BS.

3:30 - I would ask that you check your anger at the door and get someone to read that sentence to you. "It was touted as the healthiest of all such state systems means 'it was claimed or thought to be'.

Touted simply means 'boastfully or vigorously described, advertised'. During the seventies and eighties I worked for a state agency that did in fact, with regularity, claim (tout) the Mississippi system to be the most sound among all similar systems. We were told in meetings as well as through memoranda that the system was fiscally sound, solid as a rock, flush with cash, the nation's best. I assumed then and now that was true. Neither you nor I, today, have the ability to prove or disprove claims made 40-50 years ago regarding solvency - since I assume neither of us is a forensic accountant. I know at least one of us is not.

Since I didn't make the claim, and regardless of your suggestion that my recollection is bullshit, I'm under no obligation to defend or prove the accuracy of the tout. We were told what we were told. What reason to you have to doubt that?

The comments by 8:26pm could be applied to all the grandiose claims/touts that the MS Department of Education make about sky high graduation rates and student learning in general. It's all bullshit, just like the PERS dilemma.

Post a Comment