Collection of all posts on PERS

PERS released its 2011 annual report in February. The report shows while assets increased to $23.8 billion, the funding level dropped to 62.4% and the deficit of retiree payments to employee contributions increased to $470 million. The system has 161,676 active members and 83,115 retirees and beneficiaries (p.35).

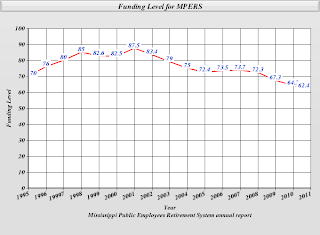

The legislature and Governor, in their infinite wisdom, chose not to discuss any PERS reforms this year. Despite their ignoring PERS, the problems continue to grow as the charts below show.

This chart shows the funding level of PERS continues to fall. What is troubling is the funding level dropped after PERS enjoyed two good years of market returns: 14% and 25%. Some PERS defenders say PERS was hit by the financial implosion of 2008 and would be fine once the markets recovered. However, PERS has done well in the markets and the funding levels still continue to fall. But of course when our leaders have their heads in the sand, they may not notice little facts such as this.

Here is the real problem- the deficit of payments to contributions keeps increasing. It is true PERS can use investment income and the assets themselves to erase this deficit. However, that is a band-aid to a problem that is getting worse each year. PERS will not always enjoy a 25% return in the markets. While it enjoyed investment income of over $3 million, suffered a loss in investment income over $3 million a few years ago. Investment income is nice when you have it but it won't always be there either.

The assets have only increased $5 billion since 2000. Two recessions hit hard as the assets fell $3 billion in the first one and nearly $7 billion in the second recession.

However, while the assets increased, so has the number of retirees as shown in this chart.

Thus the number of retirees increased nearly 50% in ten years. The average annual increase in the retirees is over 3,000.

The Governor and the legislature did not address PERS this year. While one can speculate on the reasons why they failed to do so, it is clear the financial condition at PERS is not improving as the cash flow deficit, the unfunded liabilities, and the number of retirees continue to increase despite strong performance in the financial markets. Imagine how bad the picture would be if the rate of return was in the single digits? It is unreasonable and foolish to expect these returns every year. Ignoring the problem will not make it go away.

2012 financial report, 2012 and 2011 reports

Note: Here are the investment returns for PERS over the last ten years:

2000: 8.4%

2001: -7.1%

2002: -6.6%

2003: 3.5%

2004: 14.6%

2005: 9.8%

2006: 10.7%

2007: 18.9%

2008: -8.2%

2009: -19.4%

2010: 14.1%

2011: 25%

and the rolling averages:

3-year rolling average: (5.5%)

5-year rolling average: 2.1%

10-year rolling average: 2.3%

20-year rolling average: 7.4%

30-year rolling average: 8.7%

12 comments:

Nature of the beast. What else is new? When you guarantee payouts and gamble on income you take risks.

Considering the lengths he went to demonstrate that he was some type of fiscal hawk it sure is curious why TaterCheeseCake didn't lift a finger to fix PERS last session.

I mean it sure as hell isn't because his house blogger hasn't extensively reported on the PERS sinking ship.

So what the hell is SubmarineSandwichReeves waiting for? The situation to get even worse?

3:52, if a good charter school bill can't pass the House, how do you think PERS reform will go?

Like Bryant, he has an eye on re-election. Is that too hard to understand? Tater and Feel also know damned well if they tinger with PERS they will be forced to deal with SLRP and MHP. In concert, those three systems represent one hell of a lot of voters. Oh, did I mention the black caucus? PERS also represents a mighty damned large employment agency for municipal and state employee minorities in this state. Taters asshole tightens up just like everybody elses does.

The PERS study commission had some sensible recommendations that should be championed by our new leadership.

I think the comment about charter schools and PERS is spot on.

What is sad is how many liberals in this state think there is nothing wrong with PERS and says it has $23 billion in assets so no big deal. They don't seem to understand things like cash flow, principal, and other basic finance concepts. They think they have a $23 billion credit card.

PERS is never going to command the attention it needs because it's a long term problem in the short term world of politics. Punt it down the road for someone else to solve. Virtually every elected official in office today will have moved on by the time PERS gets to the point that checks can't be written, so why should they waste political capital solving a problem that will belong to someone else? We live in a what can you do for me today world, and most voters like that just fine.

Cutting funding to state agencies and driving state workers to retire isnt helping...

I can assume there is a big problem coming. 25% returns makes me question the level of risk involved. Many pension funds, seek the protection of 'nobody ever got fired doing what everyone else did.' Much I do not know. Is this large value of assets real and based on selling now? Banks are playing 'market value' is what I say it is games to appear healthy easy to assume this is happening in this case.

I think the comment about charter schools and PERS is spot on.

No surprise that ChocolateIceCreamReeves' house blogger Kingfish wants to give the LtGov yet another pass.

Not addressing, or even trying to address, the problem because the legislation might not get through the house isn't leadership, except to PizzaPieTater's apologists.

How did I give him another pass? I said he, Phil, and Philip all dropped the ball on this one. None of them followed Haley's lead and he did the heavy lifting for them. They all deserve equal blame.

I'm not saying PERS is going broke but we need to pay attention to the current trend.

The trends only get worse but now you soft pedal that PERS isn't going broke? Before the election you were hollering that PERS had to be addressed ASAP.

Post a Comment