The financial markets continued to batter PERS as its investments were -5.2% in the first quarter of the 2023 fiscal year. PERS suffered a -8.5 rate of return for FY 2022.

Despite the negative return, investment consultant Callan said the performance tracked its benchmark, the Russell 3000 index, which fell 5.0%. The PERS portfolio has struggled for several months as its 2022 rate of return was -8.5%. Callan reported negative returns for all asset classes:Domestic equity: -4.2%

International equity: -9.8%

Global Equity: -5.2%

Fixed income: -4.3%

Real estate: -1.5%

Private equity: -5.3%

Private equity and real estate usually lag three to six months behind the other asset classes in reporting performance. a rough September took a nasty bit out of the portfolio. Callan reported (p.170):

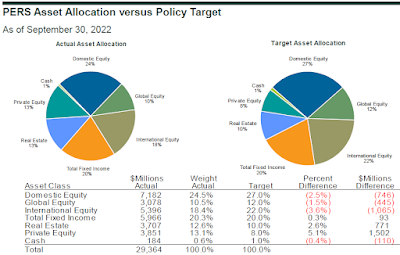

The S&P 500 was down over 4% in 3Q22 and other major stock indices fared no better; after a brief relief rally during the summer, September 2022 was one of the most difficult on record as the S&P 500 fell by 11% during the month.The portfolio remains 50% invested in equities while only 20% is in bonds. Real estate has been the strongest performing asset class but it comprises only 13% of the portfolio. Callan considers the portfolio to be under-invested in equities (7.6%) and over-invested in real estate and private equity.

The negative return shrank the PERS portfolio $1.8 billion to $29.4 billion at the end of September. The portfolio dwindled $3.5 billion in the last quarter of FY 2022 (ending June 30) and another $2 billion in the third quarter. The PERS portfolio ended FY 21 at $35.2 billion after it enjoyed a 32.7% rate of return.

The annual report will be released in December. The Investment Committee report is posted below. Start on p. 164 at the agenda.

Kingfish note: Here are some napkin numbers that will give a better idea of what to expect when the annual actuarial report is issued in December.

-8.5%: Rate of Return

$3 billion: JJ Estimated PERS benefits payments in FY22.

$2 billion: Amount of investment income recognized this year thanks to the 33% rate of return last year.

$1.3 billion: Deficit between contributions and payments. It was $1.3 billion last year. The deficit will probably increase. Expect $1.4 billion or so.

$800 million: The COLA will probably increase at least $850 million. The annual increase ranges from $47 million to $50 million the last few years.

2,300: That is the average retiree growth the last few years. Expect the retiree population to increase to nearly 115,000. It only passed 100,000 retirees in 2017.

61.5%: That is the funding level reported in December 2021. Needless to say, the funding level will probably fall a few points. Break out the jukeboxes and poodle skirts. PERS is going back to the 50's.

Market returns for PERS since 2000:

2000: 8.4%

2001: -7.1%

2002: -6.6%

2003: 3.5%

2004: 14.6%

2005: 9.8%

2006: 10.7%

2007: 18.9%

2008: -8.2%

2009: -19.4%

2010: 14.1%

2011: 25%

2012: 0.6%

2013: 13.4%

2014: 18.3%

2015: 3.5%

2016: 1.16%

2017: 15%

2018: 9.2%

2019: 6.8%

2020: 3%

2021: 32.7%

2022: -8.5%

5-year average:8.64

10-year average: 9.4%

Assumed rate of return: 7.5%

Employer Contributions

2011: 12%

2012: 14.26%

2014: 15.75%

2019: 17.4%

11 comments:

I wish I could have only lost 8.5% for FY2022. Since Biden was elected(put in office) everyone's rate of return has suffered.

In 3..2..1

.Haircut Guy

.All state, county & muni employees are laze slobs

.Defined benefit is a Ponzi scheme

.Get a real job

October was the best month in decades and Q4 could make up a lot of ground. Gridlock in DC is always best for the markets and hopefully that is what we get next week from the election.

Unrelated to PERS directly, but with the rising interest rates will that force the bond and stocks to become uncorrelated? I know when the rates were low for the past 20 years bonds ceased to act as a counter balance to stocks. As a result when stocks went down bonds also tended to as well. Will we return to more "normal" operation with higher interest rates?

S&P went up 5% in October. Dow 13-14%. Great month. One month doesn't make a year. ;-)

The problem is the inflation cake is already baked. The 40% increase in money supply already took place and the Fed is going to keep raising rates.

And those 13th bonus checks just keep getting bigger and bigger every year. Someone told me they expect theirs will reach six figures

in the next few years.....

In FY 2021, the average annual PERS benefit including the Cost-of-Living Adjustment is $25,638.

https://www.pers.ms.gov/Content/PAFR/2021_PAFR.pdf? See page 5

I hope my 13th check doesn’t decline to six figures. I couldn’t afford a cut like that.

11:15 and 2:40 (no doubt the same person) is lost in the weeds of ignorance.

1. The so called 13th check is not a 13th check. It's the annual cost of living increase taken at one time rather in 12 additions to to the monthly checks. Whether you agree or don't with the practice or how it came about or whether it should exist independent of annual inflation figures is beside the point.

2. It's not a bonus, dumbass. If you're working and are fortunate enough to receive periodic pay raises (hopefully based on your performance and value) do you consider that a 'bonus'?

8:37 The COLA can be taken as part of the monthly payments instead of a lump sum. It depends on a person's personal preferences. It is better for PERS if the COLA is taken monthly instead of a lump sum because the system has to sell stocks regardless of market conditions in order to have the cash on hand for a lump sum payout.

I'm 8:37 - Tell me something I don't know. I clearly pointed out that the so-called 13th check is simply the annual 'cost of living increase' taken at one time rather than split into monthly increases.

This money, if opted for in a one-time December payment, allows retirees to afford Christmas. It's just that damned simple.

Cash reserves fund the annual disbursement, not the 'selling of stocks'.

Post a Comment