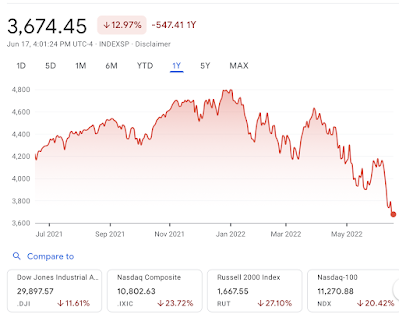

The PERS fiscal year will come to an end in 13 days. Check out the one-year performance for the S&P 500.

The S&P 500 was 4,166 on June 18, 2021. It fell 13% to 3,676 today. The PERS rate of return usually lags a couple of points behind the S&P 500. However, that trend is usually on the positive side. It is not known if the rate of return will be worse than the index.

What does it all mean? It means PERS will almost certainly have a negative rate of return although we won't know until December how bad the damage will be.

37 comments:

Not being satisfied with attacking black leadership every day, Kingfish also lashes out angrily at his second favorite target, PERS!

Will nothing ever soothe his seething rage?

How's that fixed 3% COLA looking now?

@ 3:37, "Racism is not dead, but it is on life support — kept alive by politicians, race hustlers and people who get a sense of superiority by denouncing others as racists." ~ Thomas Sowell

3:37 needs help, a lot of help

@3:57 PM - Indeed he does. Jealousy and insecurity abound.

Some things can't be helped.

irrelevant. backed by the State, so all their checks will clear. My 401K however, that's what we need to talk about.

Five year averaging Kingfish. Don’t forget.

Good thing the 13th check, aka COLA is locked in at 3%. Social Security checks will be going up 8% next time.

If that Mississippi retirement fund made money this last year, please print the results after paying out more than required funds. This is one of the biggest frauds perpetrated against the people who pay taxes in the 50th financially unstable state in the U S A. P.s. please don’t include Puerto Rico or Washington D. C. In your response.

S & P 2022 YTD is down 23%, NASDAQ 31%. Go check your 401ks…bad ramifications for PERS for sure.

@6:46

If you don’t like it, then you can always move to Minnesota or Utah. The government of the State of Mississippi signed a contract to pay me and provide my benefits for 25 years of service. I upheld my part of the contract.

3:37 PM

Audits are racist. Now Performance is racist. If I didn't know better I'd say I'm criticizing a socialist. Congratulations here's your (you).

3:37 is one of many who is unable to respond except by personal attacks. Must be a product of the public schools. If anyone has a "seething rage" it can only be 3:37. He/she/it really hates what KF reports but he/she/it can't say its false. Truth is like sunlight to people of that kind and they don't like it.

6:46, where is the “fraud”. Incompetence is much more accurate. Take your pick, we are talking about our legislature.

The PERS apologists who post here continue to surprise me. If I had spent 25 years of my life working for the state, I would be screaming for more accountability and efficiency. They act as if more competence in PERS will somehow threaten the security of their checks instead of adding more security.

An overview of PERS is incomplete without the explanation of SLURP for part-time employees who happen to pull the purse strings.

6:46 - Where were you and your snide remarks back during those early years of the COLA when it worked great? Fraud? Well, in the same sense that Social Security was fraudulently orchestrated and currently operated. Fraud indicates theft and knowingly engaging in criminal activity. PERS, like all defined benefit retirement programs, has ups and downs. You no doubt don't have a 401(k) or your typing fingers would be trembling this week. Otherwise, you and the chatty-ponzi crowd can stuff it.

Kingfish has had a hard on for PERS for two decades. It's a real easy target. Takes no original thoughts to trot out the same tired rhetoric month after month. Meanwhile, he won't say a word regarding the ultra-serious decline in value of most portfolios and particularly EVERY 401(k).

It will be greater than 13% loss due to the fact they use bonds to balance risk. Bonds have also been routed. Moreover, PERS has Russian bonds which are valued at 0. They also have MBS exposure which has had greater than 50 percent.

PERS is in real trouble... and the agencies that fund the 17.45% of salary for each state employee are going to be squealing hard when their portion goes up significantly more to cover deficit.

I'm predicting that one day there will be a run on PERS because people are scared of not even getting what they put in back, so they'll cash out - and that will be the end of it.

@3:51 - looking quite good, thanks for asking.

3:37, you do make me laugh. KF, who I don’t know from Adam’s housecat, has simply posted a graph, factual information. It’s not an attack to post objective facts.

What's so special about state employees they, alone, are entitled to have the state treasury guarantee the security their retirement?

Question: Why not offer the program to every Mississippian with a job?

Answer: Because of the low level of required employee contributions, it's not sustainable without dipping into the general fund. At a state-wide level, that would be readily apparent and there wouldn't be enough of the general fund to go around.

Give state employees matching 401Ks like the rest of us.

I write about SLRP every year and explain it as you well know. Keep making up stuff.

The market performance is noted because such a negative return almost ensures PERS goes backwards when the actuarial reports are released in December. It will be interesting to see if the consultants recommend a contribution increase.

You can scream all day long about full faith and credit. Take a look at the size of the state budget. PERS is a $30 billion portfolio. The state doesn't have the money to bail it out repeatedly.

June 18, 2022 at 4:43 AM

Not to mention that since 2008-2009 bond have been correlated with stocks. They haven't been the counterbalance they were for the past 14 years. Hopefully with interest rates going back up they will be.

Russian bonds?

You are right about the smoothing. PERS will recognize $2.2 billion in last year's investment income this year. Ok. Sounds great. It will mitigate but by how much is the question. The deficit between contributions and payments is around $1.3 billion. So take that right off the top. You have a billion left to play with. There will be no investment income from this year to fund payments. That means PERS will probably have to dip into the portfolio. The payments will probably be right at $3 billion. Don't forget retiree growth. A conservative estimate is another 2,000 retirees to 114,158.

Replying to:

"I'm predicting that one day there will be a run on PERS because people are scared of not even getting what they put in back, so they'll cash out - and that will be the end of it.

June 18, 2022 at 5:07 AM"

PERS is mandatory for qualifying positions. A refund of your contributions is only permitted following termination. No provision exists for loans, partial refunds, or hardship withdrawals of member contributions.

Refunding your account contributions means losing your membership in PERS as well as the accompanying service credit. You also waive and relinquish all accrued vested rights.

So, how do you predict "a run on PERS" and "cashing out" unless everyone is going to quit and lose all of their accrued benefits which exceed their contributions? Ain't gonna happen.

@10:37 AM

I am not the original commenter you are replying to.

I work in state gov and I see the “run on PERS” often. Every single boomer who has accumulated enough leave to meet their 25 years, is getting in the system ASAP. It is leaving huge vacancies that are going unfilled because the state pay is abysmal. Many starting salaries are lower than what fast food and Walmart are paying.

The benefits are the only attractive offerings to perspective state employees. And here we have KF reminding everyone that PERS is going to need a bailout or it will disappear. Perception is important. Our entire economy is built on government sanctioned Ponzi schemes and enforced monopolies.

To: 11:26. This is 10:37.

I guess one of us misunderstood the original meaning of "run on PERS." I did not consider putting in your full 25 (now 30) years, retiring and taking your earned benefits as a "run on PERS." I considered that simply as retirement. (Of course when folks retire as early as possible, their PERS check is not as big as if they stayed longer, so there is that...) After well over 30 years in the system, I never once heard of anyone timing their retirement based even a little bit on the perceived health of the PERS system.

But instead I was thinking a "run on PERS" was people not yet eligible to draw retirement trying to withdraw their to-date contributions to PERS. In other words a 10- or 20-year employee trying to take his money at that time and go work elsewhere. People do sometimes do that, but again IME, not because of the perceived health of PERS. Perhaps the original poster can clarify what he meant by his prediction.

1:43 PM

The "run" is the same problem that Soc Sec has: Not enough people entering the state workforce. And inability to keep. I'm not who you were responding to, but I was a state employee from '14 to '18 and left taking my PERS retirement out and rolling into a 401k.

So I guess you could call it a "slow motion run".

The 'run on PERS' that Captain Doofus predicted is impossible. That would mean a majority of state employees would quit or retire NOW and draw down all or a large part of their vested balance. That ain't happening. In short, Captain Doofus is 'ignernt' of how the system works.

You'll also hear no agency screams since those would scream are not footing the contributions.

Raise employer contributions by 5% and partner with the legislature to require that each agency and participating entity absorb/experience/enjoy a 5% reduction in fat. Then you'll hear some hearty moans.

And, NO, Kingfish...you have never, ever dedicated more than brief lip service to SLRP, and rarely at that (compared to your blabbering re PERS). You only ever mentioned SLRP as an 'Oh, by the way', comment.

You are a liar. Period.

2022 post

2020 post

2019 Bigger Pie Forum post on SLRP

2018 post

2016 post

2016 post on 2015 audit

2013 post

The SLRP numbers and the law creating SLRP as well as its history are spelled out in every SLRP post.

If that's not good enough for you, hoo bad.

Longer they wait to head over the the barber the shorter the cut they've eventually receive.

What is that on the face of 11:36?

11:36 seems quiet.

Perhaps a mouth full of crow prevents a proper defense.

@6-17 7:57

"The government of the State of Mississippi signed a contract to pay me and provide my benefits for 25 years of service. I upheld my part of the contract."

The government promised you that future taxpayers would pay you. If they weren't going to wait until it completely blows up to do something, the lack of bankruptcy law for states would ensure you get paid. But there was something like a $17B deficit before the bad returns this year. So the unfunded obligations are already larger than the annual tax revenues of Mississippi and it's going to get significantly worse this year and it's going to continue to get worse before they do anything. At some point, math stops being optional and at that time, you're not going to be able to find anybody willing or able to cram it down taxpayers throats. Politicians aren't going to volunteer to get voted out in mass by implementing confiscatory taxes, and waiting until PERS blows up ensures that the required taxes will be more than a judge could feasibly order to be implemented.

Taxpayers are going to take it on the chin, but I think it's naive to think that later recipients in PERS won't also take a good sized haircut.

Post a Comment