It's the same ol', same ol' situation

It's the same ol', same ol' ball and chain - Motley Crue

It was tempting to just re-post the PERS post from a year ago because nothing has changed. PERS remains stuck in the mud as its funding level fell to 60.5%. It's simply hard to get ahead when the portfolio only earns a 3% return and retirees continue to grow. The moribund system is not in a death spiral but it is not improving either.

PERS actually caught a much-needed break in retiree growth but this bit of sunshine was darkened by other clouds. 2020 saw only 2,037 new retirees, far below the average annual growth. The ten-year average of annual new retirees is 3,600. Fortunately, retiree growth slowed to 2,700 new retirees per year over the last five years. Explosive retiree growth in 2011 and 2012 nearly capsized PERS as it added 8,000 new retirees in just those two years. Although growth has slowed, the retiree population is now an unprecedented 110,000. Meanwhile, the number of active employees fell from 150,651 last year to 149,855 in 2020.

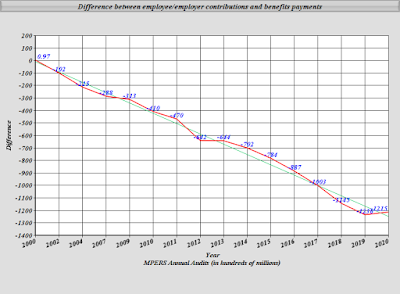

There are over 12,000 fewer active members then there were in 2011. The ratio of retirees to employees is the backbone of every pension fund. The ratio fell from 1.9 ten years ago to 1.4, where it has remained for the last three years. However, the payroll increased by $600 million. Fewer government employees doesn't necessarily mean less money for PERS as the payroll available for PERS contributions increased. Make no mistake, the chart below is PERS biggest problem.

As readers will soon see, PERS would be in more trouble this year if it experienced average retiree growth. PERS investments remained on the positive side of the ledger but they didn't earn the money needed to reach projections. The rate of return was only 3%, far short of the assumed 7.75% rate of return. The rate of return last year was 6.5%.

PERS projections are based on the assumed rate of return of 7.75%. While PERS enjoyed a positive return in the market, investment income fell short of what the assumed rate of return would generate by $283 million. The weak return generated investment income of $856,957,000 a far cry from $1.7 billion a year ago and $2.4 billion less than two years ago. The shortfall forced PERS to use its assets to pay benefits yet again.

The structural problems means PERS continues to suffer a billion-plus dollar deficit between contributions and payments every year. The deficit's death spiral actually stopped this year - thanks to the small number of new retirees - but remains over $1.2 billion.

While retiree growth and the deficit stalled, PERS was betrayed by unchecked growth in unfunded liabilities. The unfunded actuarial liabilities increased to $19.5 billion. It was only $14.5 billion in 2012 - only two employer contribution increases ago.

What does all this mean? As stated earlier, it means PERS is stuck in the mud as the funding level has flatlined around 60% since 2012. The PERS funding level fell from 60.9% to 60.5%. PERS simply is not generating enough investment income to stay ahead of its obligations in the actuarial game of cat and mouse.

PERS did not fall backwards in 2020 but it did not move forward either. PERS got good news on retiree growth but suffered weak investments. When PERS enjoys strong returns in the markets, the retiree growth explodes. The curse for PERS is that its many moving parts are not moving in a positive direction at the same time. The result is a retirement system that is stuck in the mud while its obligations continue to grow.

Note: Posted below is the audio recording of the consultant's presentation of the actuarial report. Sorry for a lack of video. Microsoft teams was used for the Board meeting. The video recorded was very pixelated and unwatchable.

PERS Notes

State employees: 17%

University employees: 12%

Public Schools: 41%

Counties: 9%

Municipalities: 10%

Here are the market returns for PERS since 2000:

2000: 8.4%

2001: -7.1%

2002: -6.6%

2003: 3.5%

2004: 14.6%

2005: 9.8%

2006: 10.7%

2007: 18.9%

2008: -8.2%

2009: -19.4%

2010: 14.1%

2011: 25%

2012: 0.6%

2013: 13.4%

2014: 18.3%

2015: 3.5%

2016: 1.16%

2017: 15%

2018: 9.2%

2019: 6.8%

2020: 3%

5-year average: 7.032

10-year average: 9.596

Employer Contributions

2011: 12%

2012: 14.26%

2014: 15.75%

2019: 17.4%

Kingfish note: The Legislature appointed Senator David Blount, Senator Bryce Wiggins, Representative Mac Huddleston, and Representative John Read to sit on the Board as non-voting members. The fox has been put in charge of the foxes. JJ posted this last year and it bears repeating.

I shouldn't have to say this but no one, including this website, is

saying PERS is running out of money any time soon. PERS has total

assets of $28 billion. However, more and more stress is placed on the

retirement system. PERS is the biggest thing in the state and

Mississippi doesn't have the money to save. Just a bailout of $100 million

taxed the state budget last year. That bailout would have doubled the

size of the teacher pay raise or paid for Medicaid expansion, or could

have been used for MDOC salaries.

The fault lies with the legislature. As former Executive Director Pat

Roberston said repeatedly, the legislature increased the benefits in

1999 without providing for a way to pay for them. The longer the

legislature delays dealing with PERS, the worse the fix will be for

retirees and that my friends, is the bottom line.

39 comments:

The literal definition of moribund is: at point of death, in terminal decline, dying or near death. Yet you refer to the system as moribund and in the next sentence you claim it's not near death. Make up your mind or either use appropriate adjectives. All defined benefit systems are growth-stalled at this point in time.

I knew you'd get around to your typical PERS death-march and New Orleans Jazz funeral before the year expired. There would be cause for alarm if everybody retired in 2021 prior to July 1, but chance of that is slim.

Lambast by Kingfish in 3..2..1 (Merry Christmas anyway)

Fire All State Employees in 5..4..3

They're all slackers and should not have this system in 6.

The same definition you quoted also said it could be "lacking in vitality or vigor".

Despite the wild swings, this has been a very good year for equities. This is not good news for PERS to have meager growth this year.

With over 150,000 participant population, PERS is getting close to being the largest city in the state.

3% is pathetic under any circumstances but paying a bunch of do nothings to deliver that poor return is tragic.

My stock portfolio is up 34% this year- I manage it myself.

PERS investments must be under the mattress.

Stock market exploded this year. How do they manage such small returns????

Somebody call Jeff Bezo's exwife and tell her PERS needs a bailout. Se has the cash.

The state lacks the additional tax capacity to solve even 1/4 of its funding needs. The law of diminishing returns in a state already revenue damaged by its inability to retain its youngest taxpayers precludes a PERS bailout using higher taxation. And no amount of liberal embrace and folderol suddenly reverses the in-country migratory patterns in Mississippi's favor. The inevitable haircut for retirees is coming. It is only a matter of when.

With an account this large, some people are getting rich. Why not list who is getting paid to (mis)manage this account, and how much are they being compensated for these less than competitive rates of return? It is our money, we have a right to know.

3.5% is inexcusable for equities and fixed income in 2020. Maybe these politicians should look in the mirror and realize that they are the problem. I work with bulge bracket IB's and I have no doubt some of these guys would be laughed out of the room if they were making a pitch.

Just one look at the leadership tells me all that I need to know. No one with any experience at companies like JPM, UBS, CS, GS, or the like. Hell, no one with INVESTMENT BANKING EXPERIENCE AT ALL!!!! The CIO is a small time bank executive masquerading as an actual Investment Officer/Analyst. Take a look at the trustees, my gawd. ROTFL. Those bios tell me everything I need to know.

https://www.pers.ms.gov/Content/Pages/Leadership.aspx

Attn 11:19 I can assure you Mrs. Bezo’s money is not managed by those managing the Mississippi retirement fund.

For those commenting on the relatively low rate of returns, keep in mind this is as of June 30 and not as of today.

S&P 500 June 30, 2019 - 2,942

S&P 500 June 30, 2020 - 3,100

That's 5.3% growth in the S&P 500 over the same time frame, so PERS is lagging some but not as much as it would look like compared to today when it has increased an additional 20% since the end of June.

A conservative, simple and safe blue chip dividend oriented index funds I own is up +13.15 CAGR over the last 4 years and +10.37% CAGR over the last decade. What the hell are they doing at PERS?

(If it wasn't for Obama the return would have been even better.)

The report is for FYE 6/30/20. The bulk of this years stock market returns have been after 6/30/20.

Calling Mr. Shad!

Give all the money back to the state employees and let them invest it in their own 401k's.

Does anyone know if County Volunteer Fire Departments are eligible for PERS or benefits? The 2 dept listed on an Official County Economic Development website list them as "Public Administration" & the 15th & 16th largest "employer" in the county with 20 members each.

The County Public School system is the 3rd largest employer with 100, but that number is low balled.

The ONLY Grocery store in the County is the 12th largest employer with 30. They've never had 30 shoppers at one time, much less 30 employees. In their height, they had 7 full time, including the owners + 5 part time.

Solution is easy. No retirees then no need for money.

Let Tate and Trump keep telling people not to wear masks and that a pandemic is not real....soon enough there will be fewer takers of the money.

I am assuming this return is net of the likely huge fees they pay to investment advisors. I get being diversified, but these private equity and hedge fund investments they get sold, in my opinion, are not appropriate for pension funds. Just look at the list of different investment companies they are tied up with. They could do better by spreading their money over every Vanguard fund they could get their hands on.

Just keep sendin' my damn check every month.

I have two stock accounts. One is up 72 percent YTD and the other is up 11 percent YTD.

Wonder if those wanna be fancy people would scoff at me because I'm a public school teacher and didn't major in business? Sounds crazy, but maybe I need to take my money out and handle it myself. 3 percent? Wow.

Kingfish, don't they need a certain percent of the portfolio in bonds? Still they suck.

...I mean not bad if just through the end of June.

Didn't the PERS return stink last year too though?

@2:15pm

"Solution is easy. No retirees then no need for money." News flash: They are already in the process of slashing state employees, primarily in education, and at all levels. Forcing them to retire or quit. They want them OFF the rolls before the Legislature increases the agency contributions required to 24% (!!!) just to keep it afloat. Believe it.

But hey, the six-figure folk will stay and survive.

The State Auditor needs to take a look at the relationship between the individuals running PERS and those at the investment firm’s managing the money. I agree with others, 3.5% is ridiculous. Like most I am not even close to an investment professional, but I have doubled my portfolio in the last 6 years. Something stinks, and if I had to guess, somebody is taking some nice vacations and eating at nice restaurants all paid for by the investment firm, but ultimately paid by retirees and taxpayers. As a current retiree I have sent messages to the State Auditors Office asking for someone to look into the management at PERS. All current state employees and current retirees need to do the same. Maybe if enough start asking something will be done before the system goes bankrupt.

"News flash: They are already in the process of slashing state employees, primarily in education."

Yep.

And what is the latest figures of the kids being pulled out of public schools ?

I think over 20 K in the Jackson "District".

I wonder why ?

MHP and SLRP will bankrupt the State in 22 years. I’m glad I’m on one of the old Municipal plans separate of the State funds.

2:15 I agree with what you say about the Darwin award. But doesn't the surviving spouse still get a benefit?

Need to drop the expected return to 6%.

Drop the expected return to 6 and you will need to increase the employer contribution to 25 or above.

The investment period is from July l, 2019 to June 30, 2020.

BREAKING! The 'retiree haircut' guy is back. Haven't heard from him in awhile. But, he doesn't understand that 'retirees' will not be affected, no matter what. Current employees will be.

In line with contractual agreement, thirteenth checks arrived right on time, eight days ago. Suck it up, haircut guy.

According to a Sun Herald article about the Walkers, Bill and his wife get retirement checks of around 17K a month and a check each in December for around 29k each. Even if this isn't typical, it is insane.

Should have never done the 13th check. That money needed to go back into the fund to build up the money on hand. This was stupid to allow the Legislature to approve this. Oh and by the way, the annual estimated return should be based on 4%. I know that the amount the state pays in may increase but we should never have allowed these "experts" to have done this.

Once again the fool @1:12 who thinks retirees possess an ironclad never-surrender contract posts what the fool must.

10:35 AM

I wouldn't fire them. I'd just make them all have X level Pins. For those of you who are not familiar with the state system, ITS (that is Mississippi Department of Information Technology Services) controls positions via a PIN system. You can only advance if someone retires and a PIN becomes available.

On a side note this would have the added benefit of raising salaries to attract better talent. About a 20-25% raise. Which still is well below market rates. Just go to the Job descriptions and see how low some of the rates are.

https://agency.governmentjobs.com//mississippi/default.cfm?action=agencyspecs

Warren Buffet knows what these clowns running PERS do not know-

https://money.cnn.com/2018/02/24/investing/warren-buffett-annual-letter-hedge-fund-bet/index.html#:~:text=One%20decade%20ago%2C%20Warren%20Buffett,outlined%20the%20final%20tally.

3:12 - The system has operated for years, decades on assigned PINs. Agency heads get around it by employing non-status and contract workers, but the latter don't participate in PERS.

11:03 - I'm the fool at 1:12. Stuff your haircut and prove me wrong.

PERS staff and board must publicly call legislative leadership out before its too late.PERS staff must present a plan of suggestion for action.

Interesting that every December...This blog, Y'all Politics and that Bigger Pie bunch of yahoos all come out against PERS...just as the legislature is about to hit town. Is that sheer coincidence or a sophomoric attempt to influence legislation?

Because December is when the annual actuarial reports are released, knucklehead.

Post a Comment